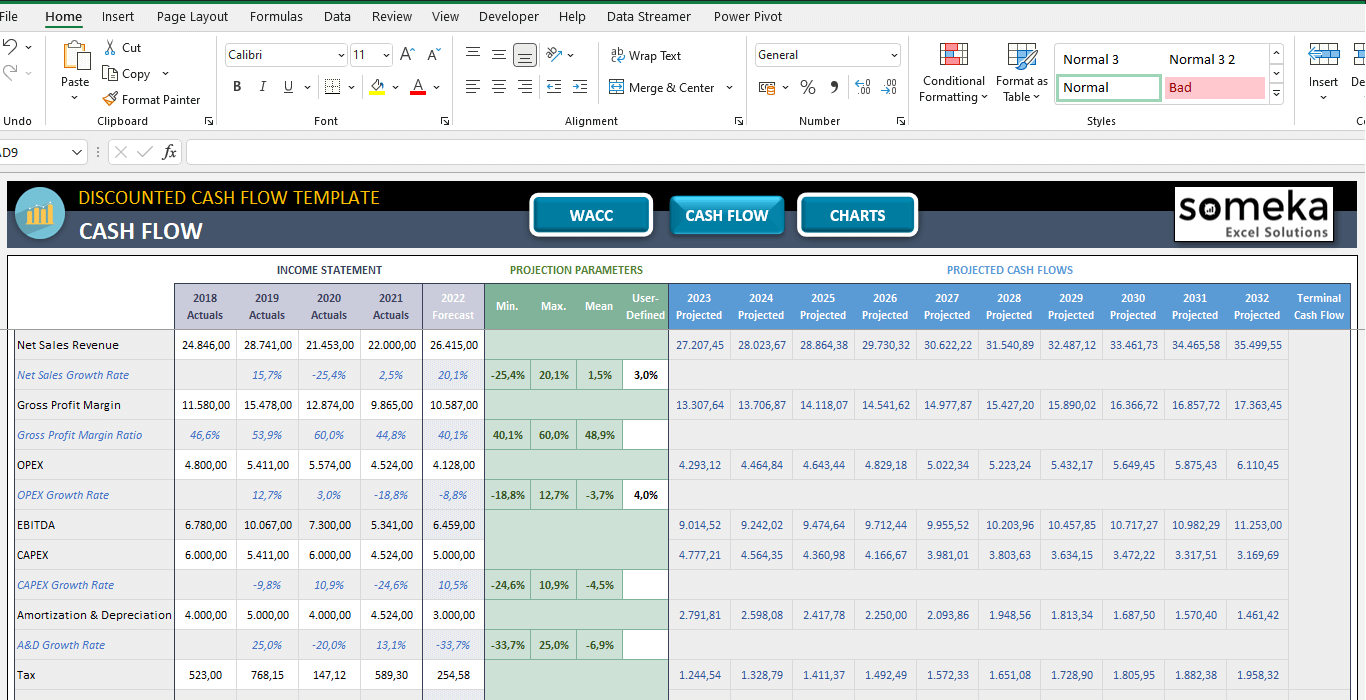

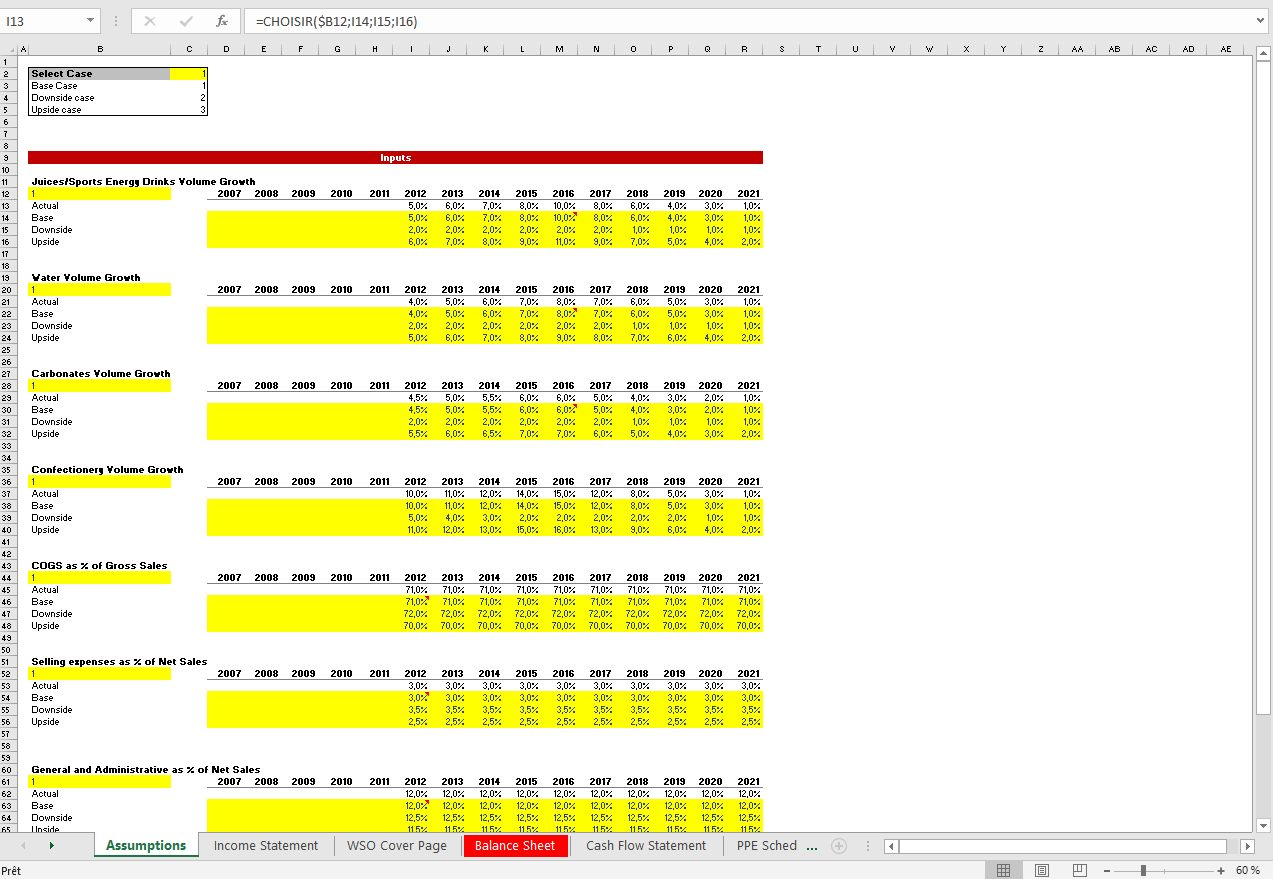

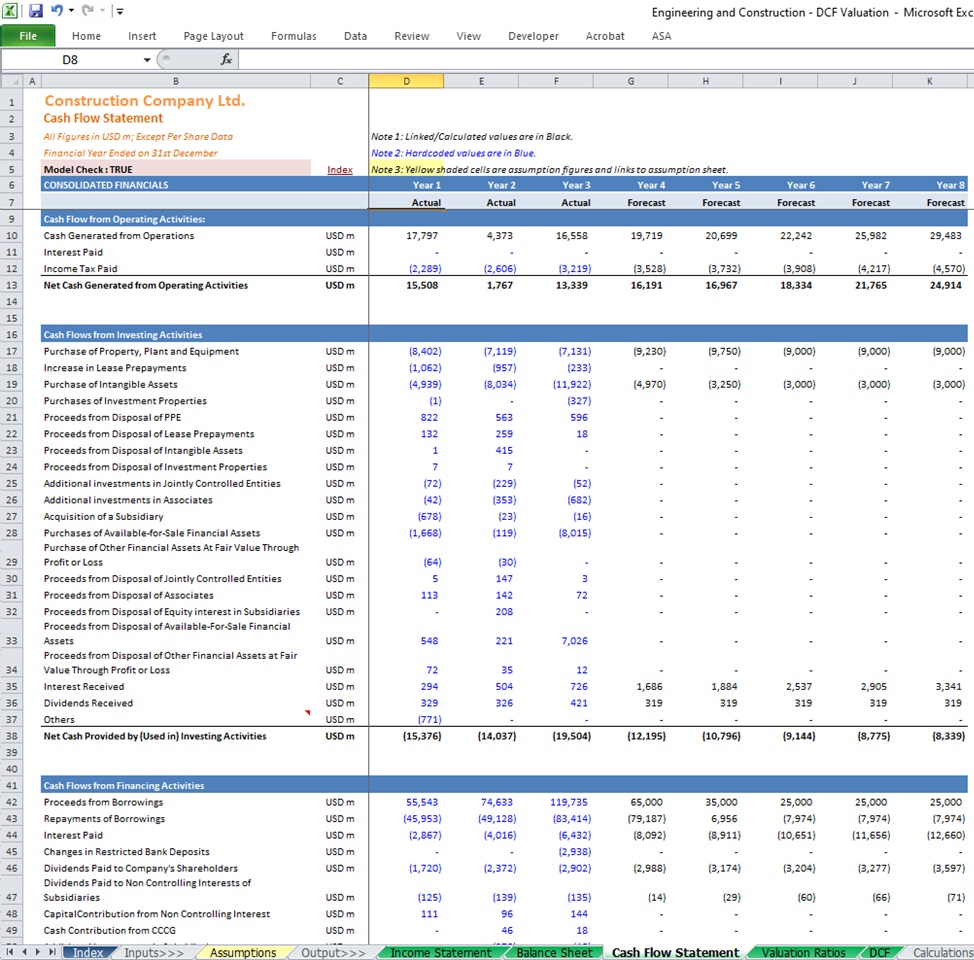

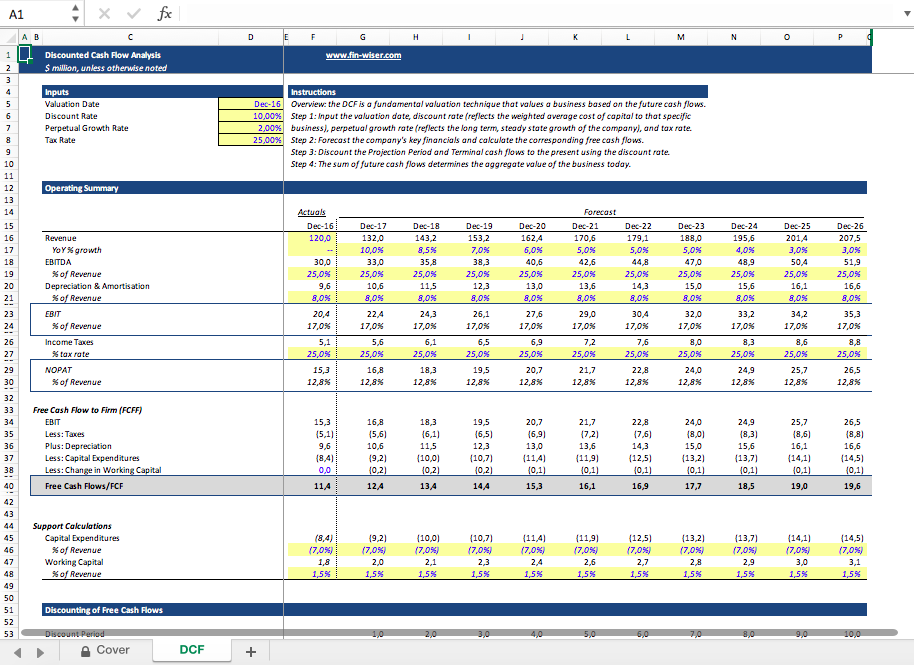

Discounted Cash Flow Excel Template

Discounted Cash Flow Excel Template - Get powerful, streamlined insights into your company’s finances. Web the formula for dcf is: Fast track your financial management efforts. Web discounted cash flow valuation model: Discounted cash flow valuation template ; Web discounted cash flow model template; Assume that we have projected cash flows of $100, $200, $300, $400 and $500 for the next five years, and we want to use a discount rate of. Book a playbook demo to explore — schedule a call with us. Net present value (npv) and internal rate of return (irr). Where, cf = cash flow in year.

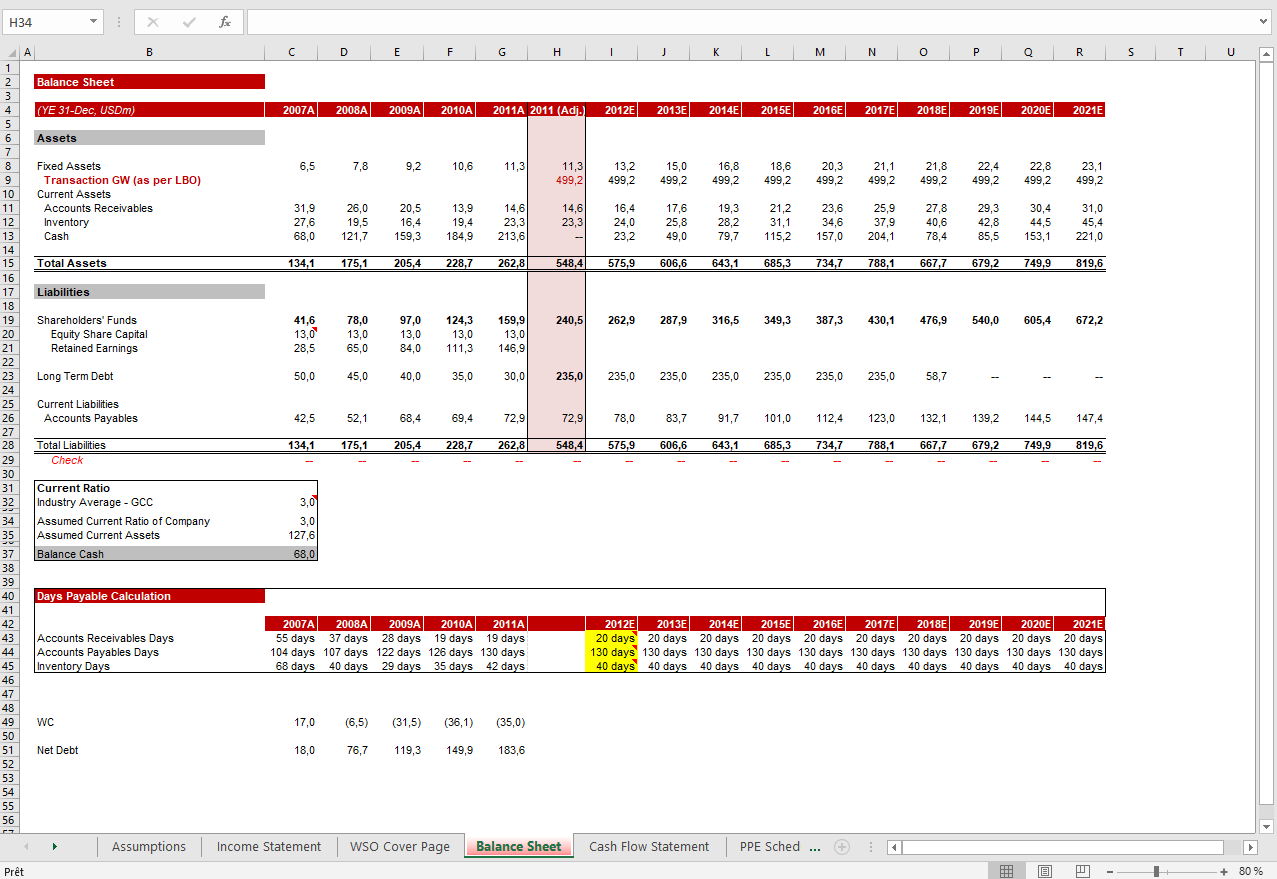

Discounted Cash Flow Excel Template DCF Valuation Template

Download wso's free discounted cash flow (dcf) model template below! The dcf formula allows you to determine the. Web here’s an example: Web discounted cash flow valuation model: Get powerful, streamlined insights into your company’s finances.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web here’s an example: Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. The purpose of the discounted free cash flow financial model template is to provide the user with a. In brief, the time value of. Web there are two.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

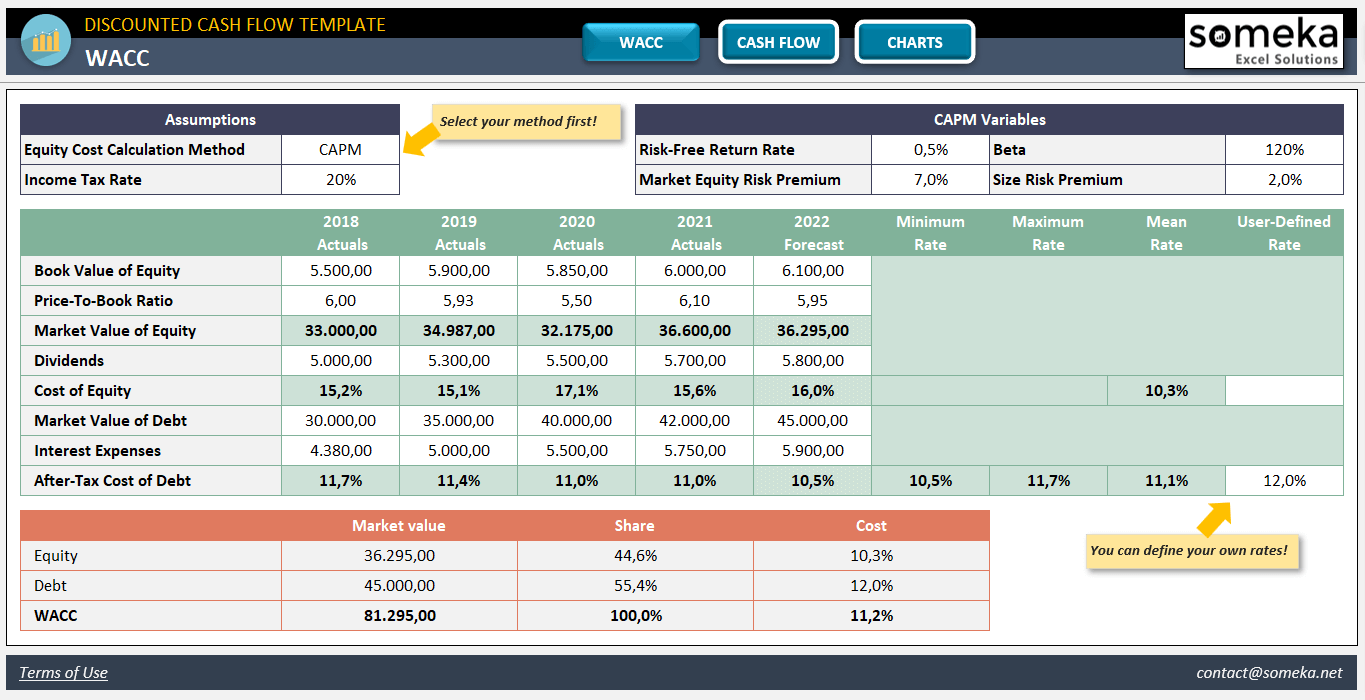

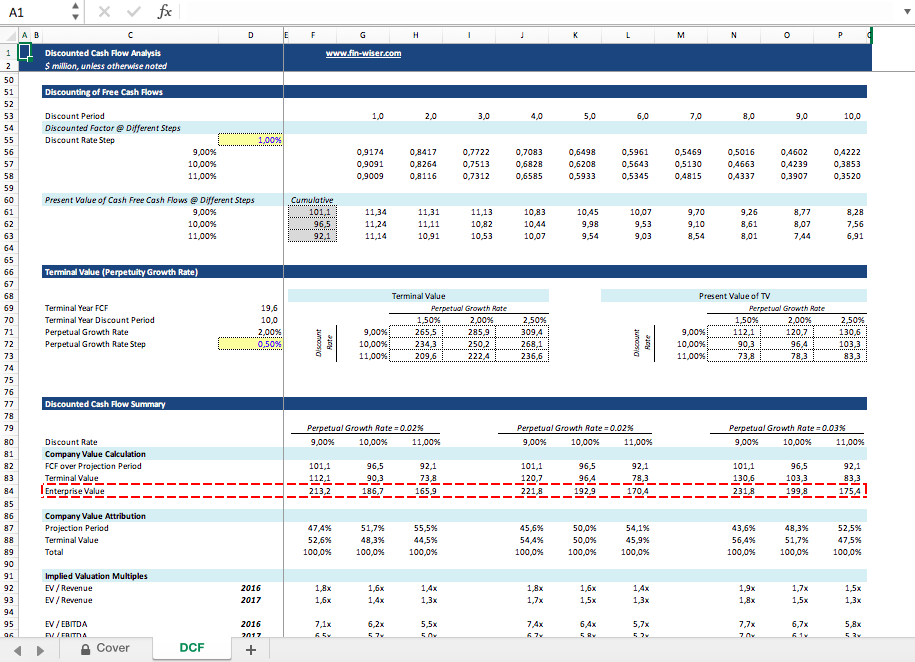

Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Web there are two financial methods that you can use to help you answer all of these questions: This template allows you to build your own discounted cash flow..

xpressbasta Blog

Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Both npv and irr are referred. It computes the perpetuity growth rate. Where, cf = cash flow in year. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. (tcs) dcf excel template main parts of the financial model: Web discounted cash flow valuation model: Both npv and irr are referred. Assume that we have projected.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web the container store group, inc. Web january 31, 2022. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Fast track your financial management efforts. Net present value (npv) and internal rate of return (irr).

discounted cash flow excel template —

The purpose of the discounted free cash flow financial model template is to provide the user with a. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years,.

Discounted Cash Flow Excel Template DCF Valuation Template

Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. (tcs) dcf excel template main parts of the financial model: Web discounted cash flow valuation model: Fast track your financial management efforts. Discounted cash flow valuation template ;

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Discounted cash flow analysis template; Net present value (npv) and internal rate of return (irr). This template allows you.

Discounted Cash Flow (DCF) Model Excel Template Eloquens

The dcf formula allows you to determine the. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web here’s an example: Web the container store group, inc. Download wso's free discounted cash flow (dcf) model template below!

Web here’s an example: Web discounted cash flow model template; Both npv and irr are referred. Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Net present value (npv) and internal rate of return (irr). Web january 31, 2022. Book a playbook demo to explore — schedule a call with us. Where, cf = cash flow in year. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web discounted cash flow valuation model: (tcs) dcf excel template main parts of the financial model: Web period #1 (explicit forecast period): Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Get powerful, streamlined insights into your company’s finances. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Discounted cash flow analysis template; It computes the perpetuity growth rate. This template allows you to build your own discounted cash flow. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows.