Discounted Cash Flow Template Excel

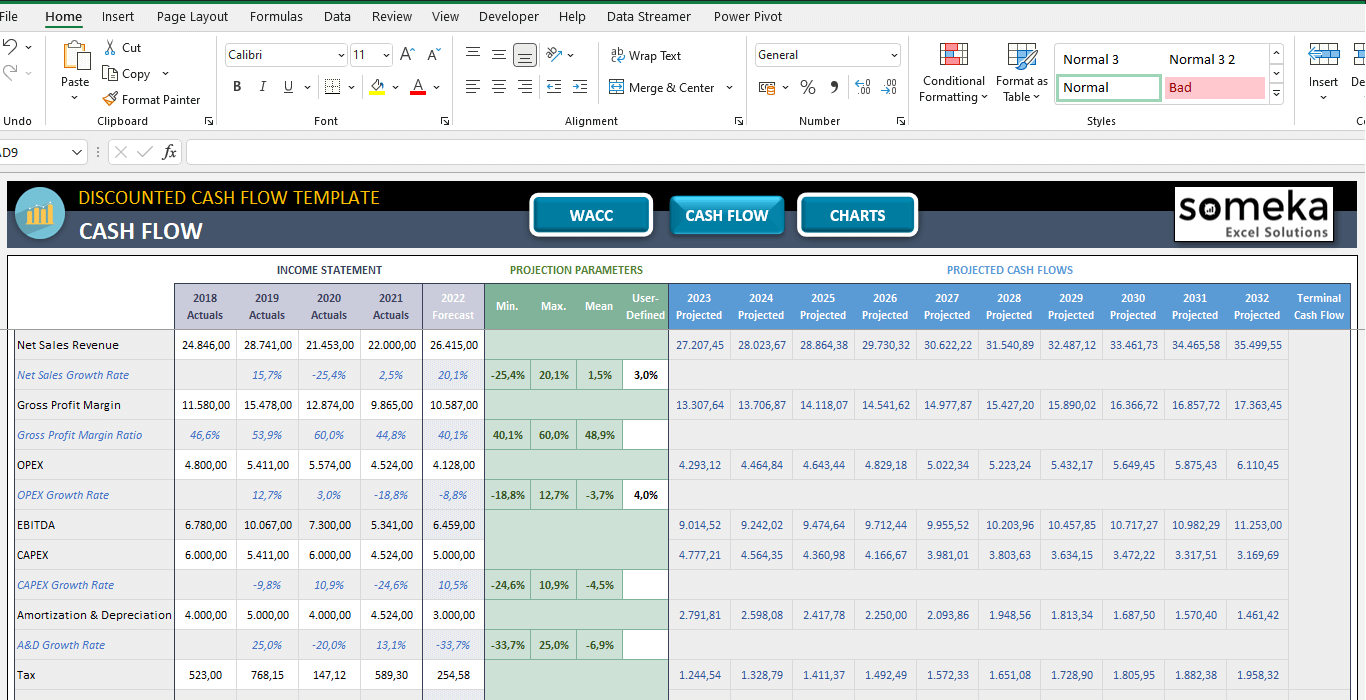

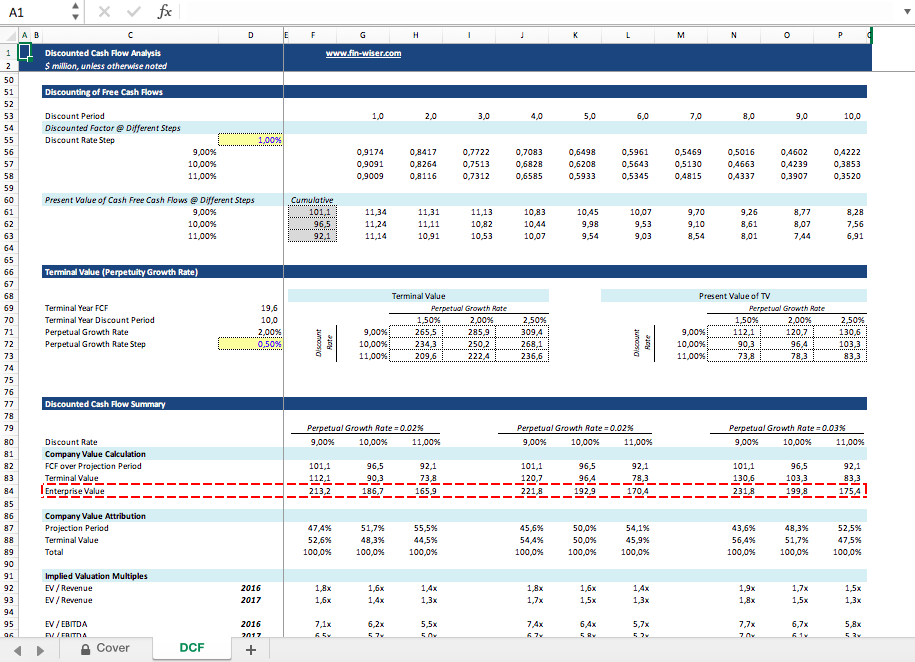

Discounted Cash Flow Template Excel - It computes the perpetuity growth rate. Web the formula for npv is: Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Present value factor = 1 / ( (1 + discount rate) ^ number of years). The dcf formula allows you to determine the. Alexandra ragazhinskaya last modified by: Web the formula for this is: The discounted cash flow formula; Where, cf = cash flow in year.

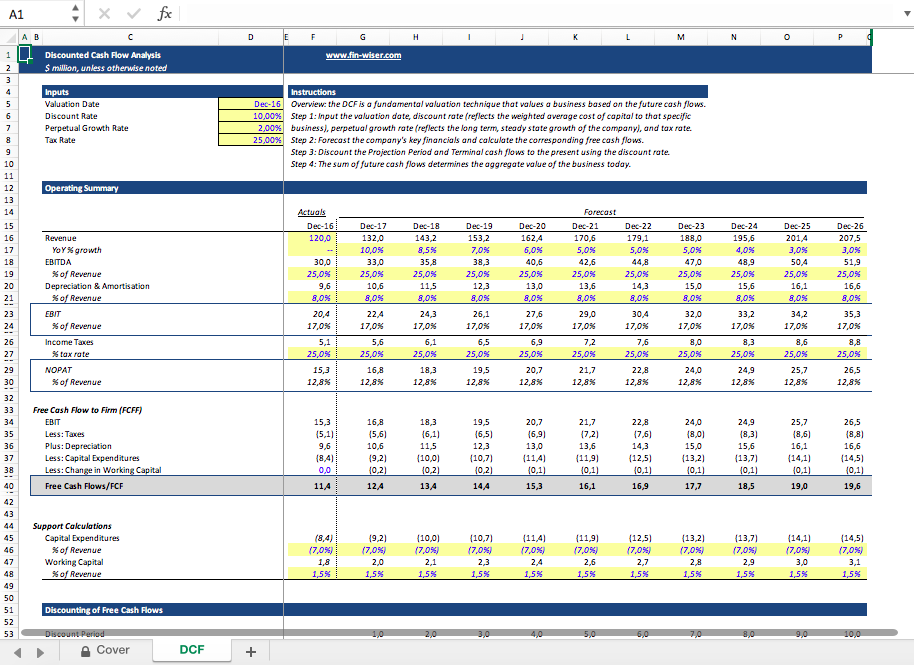

Discounted Cash Flow (DCF) Model Excel Template Eloquens

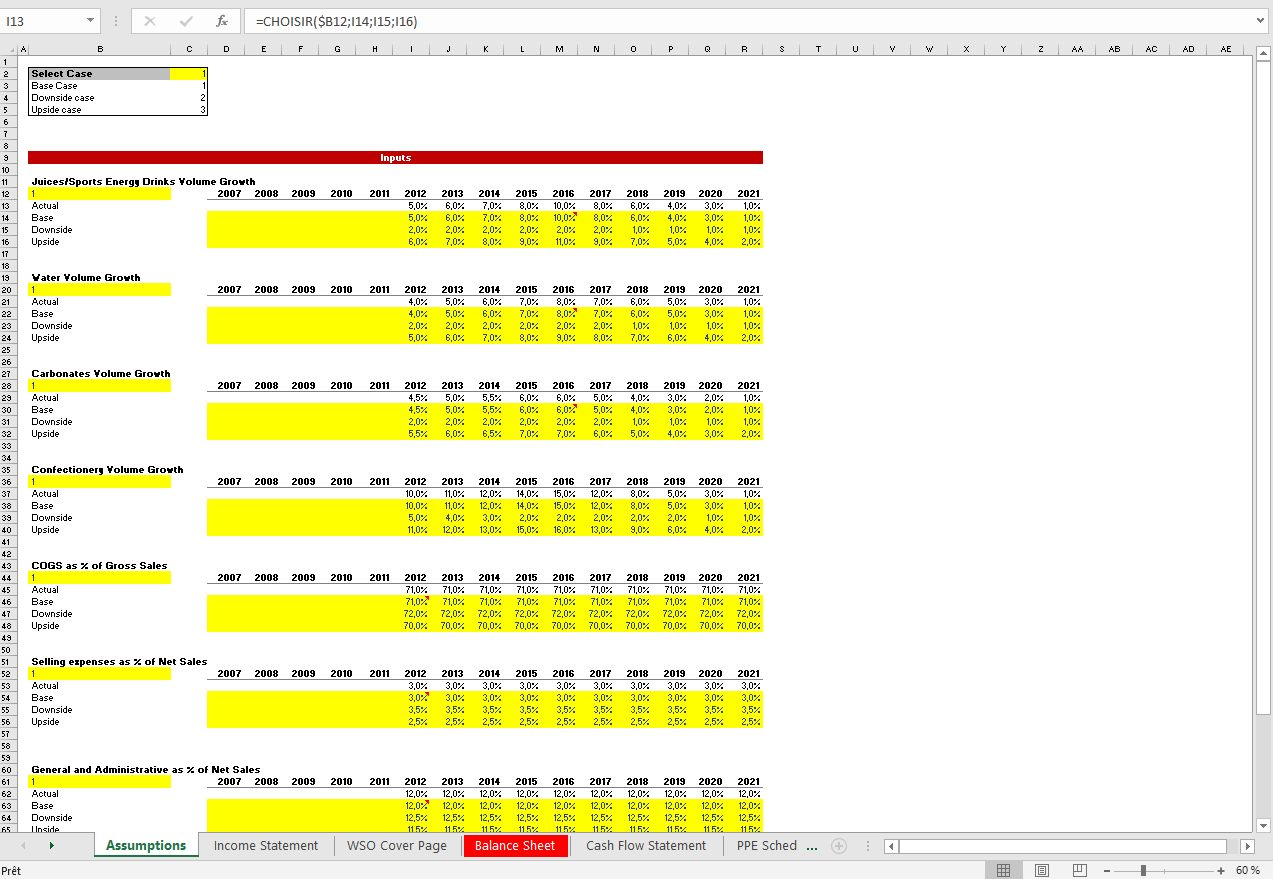

Where, cf = cash flow in year. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Download wso's free discounted cash flow (dcf) model template below! Web the formula for this is: Web discounted cash flow excel template features summary:

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web january 31, 2022. This template allows you to build your own discounted cash. Fast track your financial management efforts. The discounted cash flow formula; Present value factor = 1 / ( (1 + discount rate) ^ number of years).

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. The dcf formula allows you to determine the value of a. It computes the perpetuity growth rate. Multiply each projected cash flow by its corresponding present value. Web discounted cash flow.

Discounted Cash Flow Excel Template DCF Valuation Template

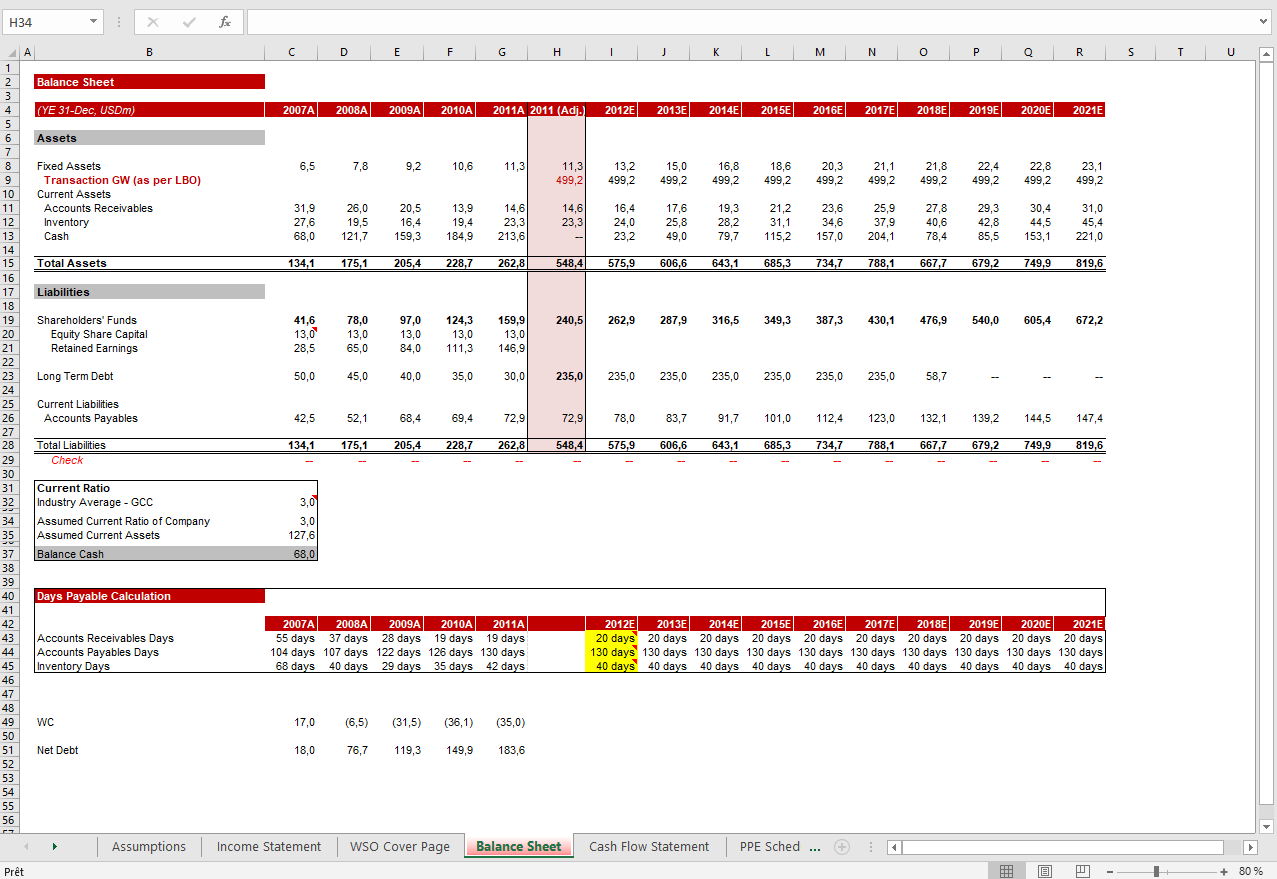

Web sample discounted cash flow excel template discounted cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Alexandra ragazhinskaya last modified by: (tcs) dcf excel template main parts of the financial model: Where n is the number of cash flows, and i is the interest or.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Where, cf = cash flow in year. Download wso's free discounted cash flow (dcf) model template below! The dcf formula allows you to determine the value of a. You can think of it as a special case of npv,. Web the formula for this is:

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web on this page, you’ll find the following: Where n is the number of cash flows, and i is the interest or discount rate. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic. The dcf formula allows you to determine the. Present value factor = 1 / ( (1.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

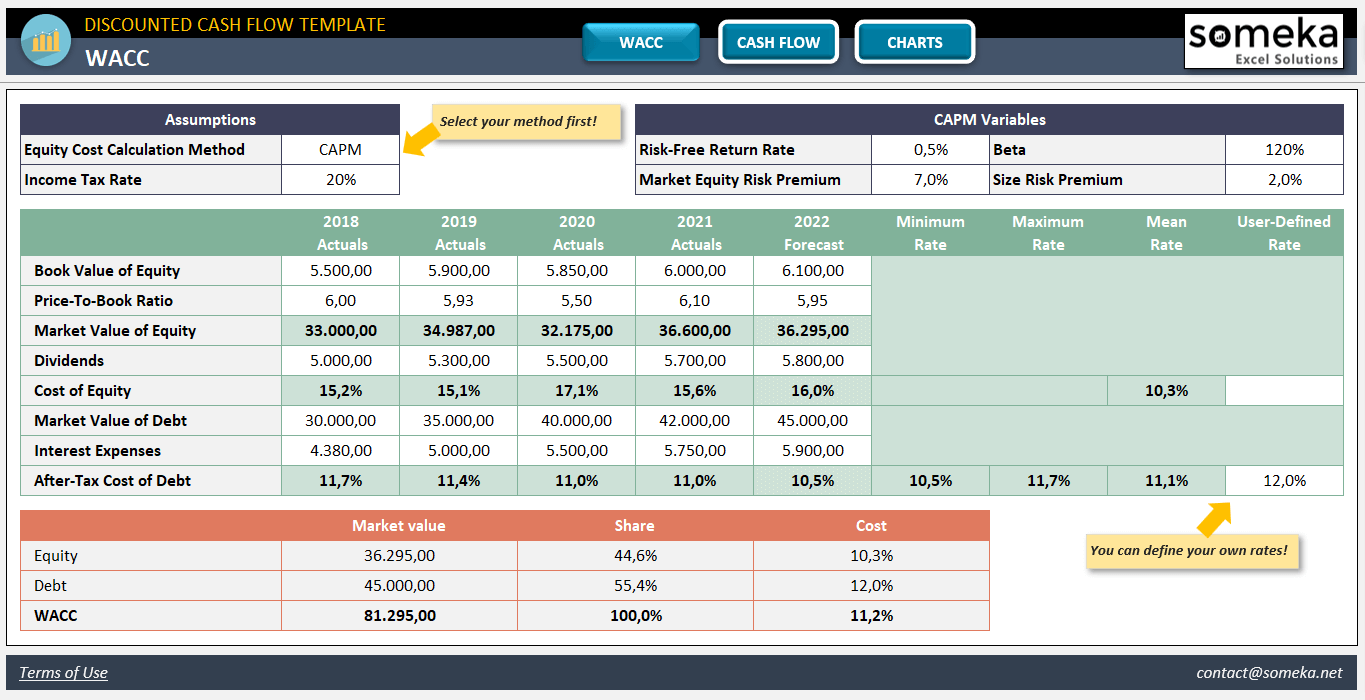

This template allows you to build your own discounted cash. It computes the perpetuity growth rate. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Download wso's free discounted cash flow (dcf) model template below! * dashboard, * income statement, * cash flow, * balance sheet, * wacc.

7 Cash Flow Analysis Template Excel Excel Templates

(tcs) dcf excel template main parts of the financial model: * dashboard, * income statement, * cash flow, * balance sheet, * wacc. Web the container store group, inc. Fast track your financial management efforts. Multiply each projected cash flow by its corresponding present value.

Discounted Cash Flow Excel Template DCF Valuation Template

Web discounted cash flow excel template features summary: Present value factor = 1 / ( (1 + discount rate) ^ number of years). It computes the perpetuity growth rate. The dcf formula allows you to determine the. Web january 31, 2022.

discounted cash flow excel template —

Book a playbook demo to explore — schedule a call with us and. This template allows you to build your own discounted cash. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining.

Multiply each projected cash flow by its corresponding present value. You can think of it as a special case of npv,. Book a playbook demo to explore — schedule a call with us and. Web the formula for npv is: The dcf formula allows you to determine the value of a. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Irr irr is based on npv. Alexandra ragazhinskaya last modified by: Web the formula for this is: Web january 31, 2022. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web sample discounted cash flow excel template discounted cash flow. Web the container store group, inc. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Where n is the number of cash flows, and i is the interest or discount rate. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Web download this cash flow calculator template design in excel, google sheets format. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow.