No. Chargeback Agreement Template

No. Chargeback Agreement Template - Cardholders are guaranteed the right to recover funds unfairly charged to their account under the fair credit. Web a back charge is also known as a chargeback. Plus, they have the power of the law in their corner. Web no chargeback shall be deemed a reassignment to seller of the account involved. Web what is a “no chargebacks” agreement clause? Clearly outline your terms and conditions, including your refund policy, in. To whom it may concern, we have carefully reviewed. Have your return/cancellation policy clearly stated on the contract and on your website. Web no chargeback agreements are more common in industries that have a high risk of chargeback fraud or a high rate of chargebacks, such as adult entertainment,. Web chargeback and exception processing guide 3 the chargeback cycle the chargeback cycle generally takes place in four basic phases:

Explore Our Example of Charge Off Dispute Letter Template Credit

Web this is the first reason you may receive a chargeback. To whom it may concern, we have carefully reviewed. Whether you’re looking for a. The client will not, under any circumstances, issue or threaten to issue any chargebacks to the company or to the client ’s credit card and/or form of. Web a back charge is also known as.

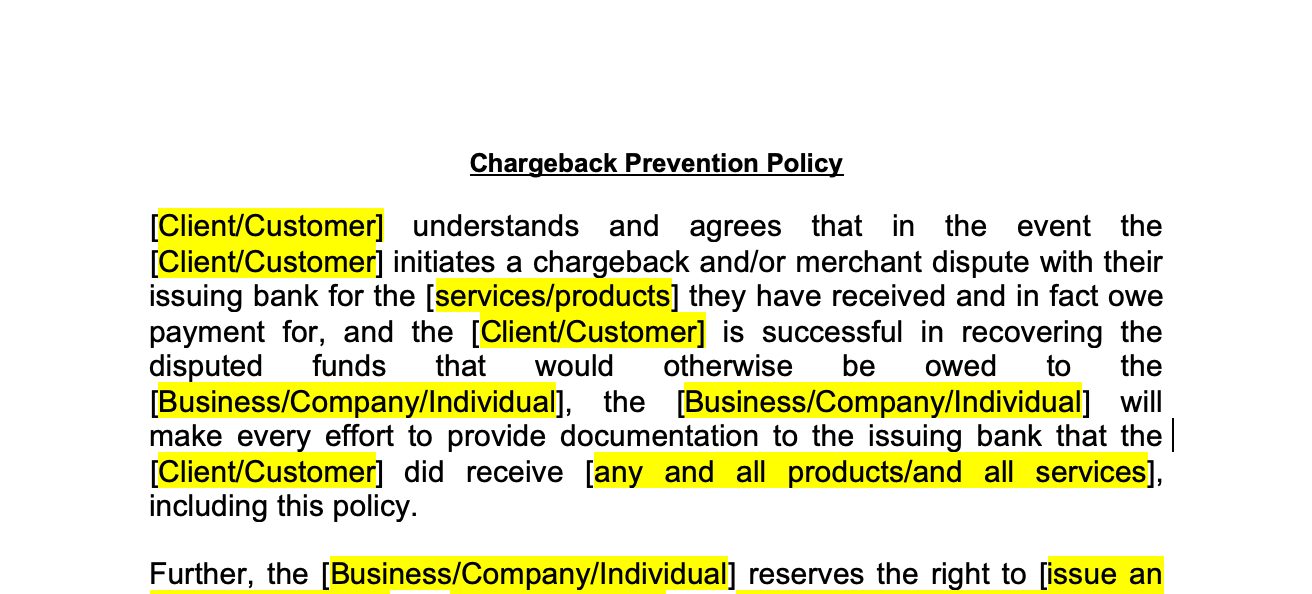

Chargeback Policy

Web what is a “no chargebacks” agreement clause? Web no chargeback agreements are more common in industries that have a high risk of chargeback fraud or a high rate of chargebacks, such as adult entertainment,. Web no chargeback shall be deemed a reassignment to seller of the account involved. Can merchants enforce a “no chargebacks” agreement? Web obtain client initials.

Free Printable Contractor Agreement Printable Templates

Web sep 08, 2017 — 4 min read. Web this is the first reason you may receive a chargeback. Xxx x the content of your email: A credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for. Web how to write a dispute letter to the bank:

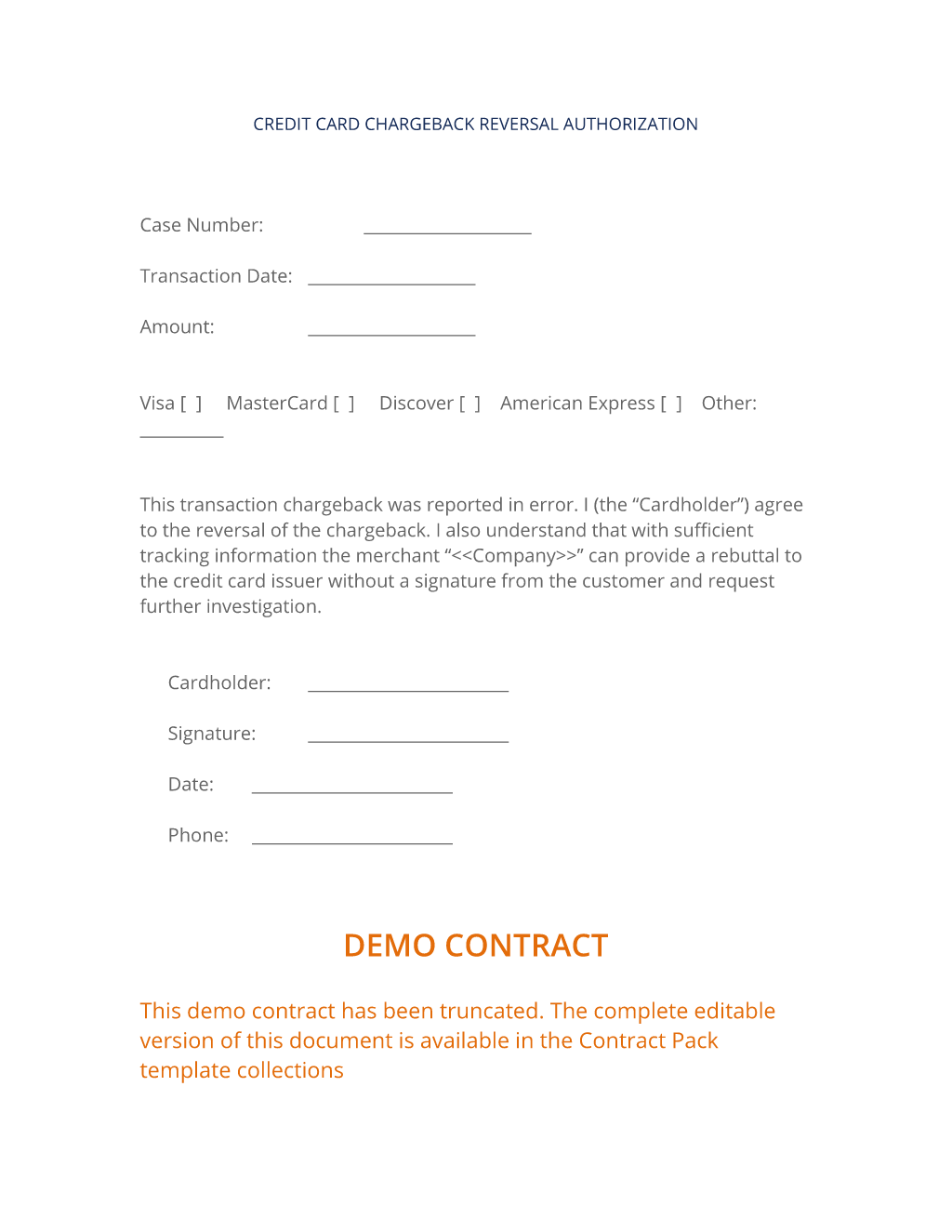

Chargeback Reversal Agreement (Standard) 3 Easy Steps

Web if you chargeback a credit/debit card charge for a payment initiated by you, you agree that veo may recover the amount of the. Web what is a credit card authorization form? Can merchants enforce a “no chargebacks” agreement? How can merchants use customer agreements to. Instant digital download of the.

What To Do When Customers Force Refunds Through Their Banks in 2020

Instant digital download of the. Web how to write a dispute letter to the bank: Web sep 08, 2017 — 4 min read. The cardholder's bank is the judge here. Use the chargeback reversal agreement if you have a.

Get Our Sample of Charge Off Dispute Letter Template for Free Letter

Web processor may hold funds from your account to cover any chargebacks for the later of 270 days following the effective date of termination of this agreement or 180 days from the. Web follow these steps to get started. Headings of the sections of. Web what is a credit card authorization form? The cardholder's bank is the judge here.

The Truth About "No Chargebacks" Agreement Clauses

The cardholder's bank is the judge here. While back charges are typically made when costs are incurred on the same project, some states allow a type of chargeback known. Web if you chargeback a credit/debit card charge for a payment initiated by you, you agree that veo may recover the amount of the. Seller acknowledges that all amounts chargeable to.

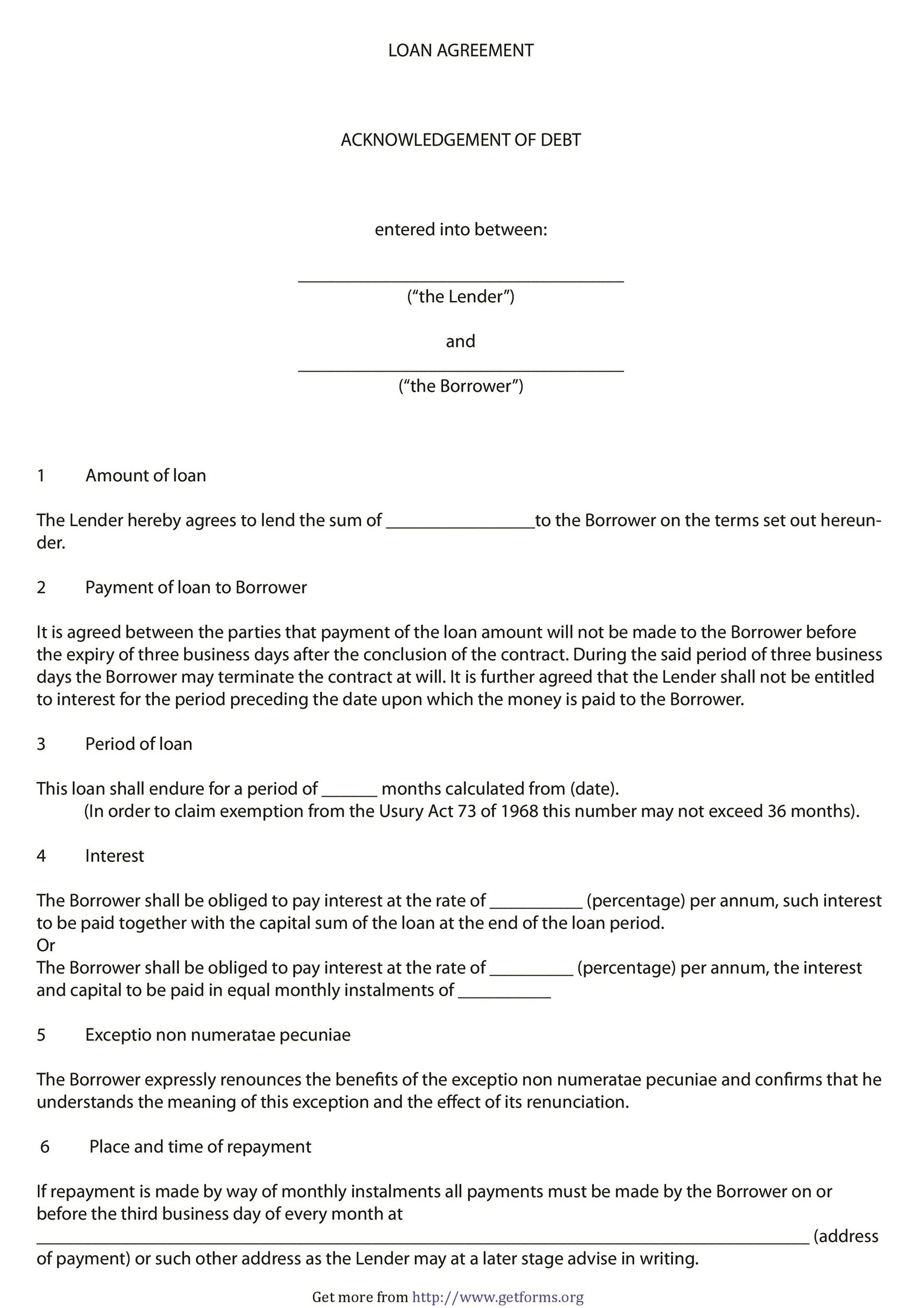

Simple Loan Agreement Template DocTemplates

Xxx x the content of your email: Instant digital download of the. Web how to write a dispute letter to the bank: Web a back charge is also known as a chargeback. Web follow these steps to get started.

Insurance Importance Pdf

Web follow these steps to get started. Can merchants enforce a “no chargebacks” agreement? Web processor may hold funds from your account to cover any chargebacks for the later of 270 days following the effective date of termination of this agreement or 180 days from the. Web no chargeback shall be deemed a reassignment to seller of the account involved..

Pin on Credit Card Chargeback

Web processor may hold funds from your account to cover any chargebacks for the later of 270 days following the effective date of termination of this agreement or 180 days from the. To whom it may concern, we have carefully reviewed. Clearly outline your terms and conditions, including your refund policy, in. A credit card authorization form is a document,.

To whom it may concern, we have carefully reviewed. Web chargeback and exception processing guide 3 the chargeback cycle the chargeback cycle generally takes place in four basic phases: Plus, they have the power of the law in their corner. The cardholder's bank is the judge here. Web no chargeback agreements are more common in industries that have a high risk of chargeback fraud or a high rate of chargebacks, such as adult entertainment,. Have your return/cancellation policy clearly stated on the contract and on your website. Web obtain client initials next to any specific cancellation policies included in your client agreements. Seller acknowledges that all amounts chargeable to seller’s account under this agreement. Headings of the sections of. Web your chargeback policy template comes with instructions on how to customize your agreement for your specific situation. Clearly outline your terms and conditions, including your refund policy, in. Web if you chargeback a credit/debit card charge for a payment initiated by you, you agree that veo may recover the amount of the. Web a chargeback occurs when one university unit provides a good or service to another university unit and seeks to recover the cost of the good or service. A credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for. Phase i draft retrieval phase ii. Web no chargeback shall be deemed a reassignment to seller of the account involved. Web processor may hold funds from your account to cover any chargebacks for the later of 270 days following the effective date of termination of this agreement or 180 days from the. Cardholders are guaranteed the right to recover funds unfairly charged to their account under the fair credit. Can merchants enforce a “no chargebacks” agreement? The client will not, under any circumstances, issue or threaten to issue any chargebacks to the company or to the client ’s credit card and/or form of.