Present Value Excel Template

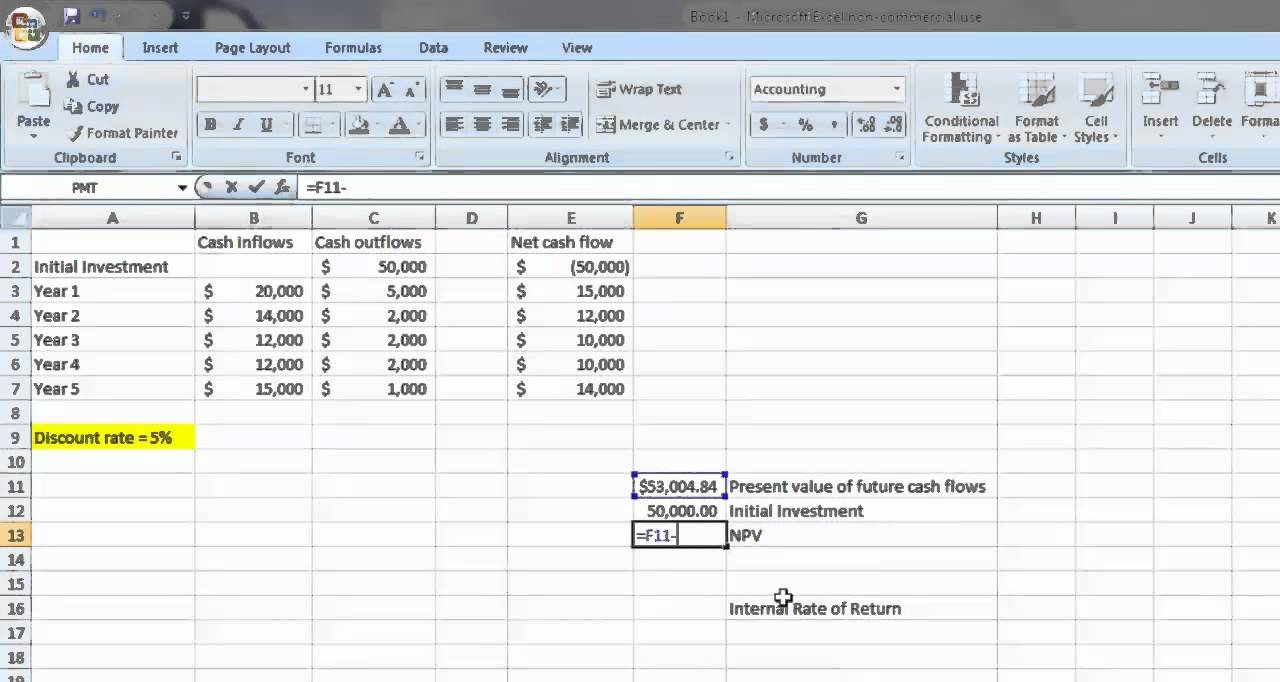

Present Value Excel Template - Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Find deals and low prices on popular products at amazon.com April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a project or investment can be analyzed. Step 2 calculate the net value of debt financing (pvf), which is the sum of. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Web the syntax for calculating present value ( pv) is: Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Web pv= fv / (1+r)^n where, pv = present value fv = future value r = interest rate per period in decimal form n = number of periods/years you plan to hold onto your investment what is future value?

Net Present Value Excel Template

Syntax npv (rate,value1, [value2],.) the npv function syntax has the following arguments: In other words, you can find out the value of future incomes discounted to. Irr irr is based on npv. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. The net present value (npv) of an investment.

8 Npv Calculator Excel Template Excel Templates

Where n is the number of cash flows, and i is the interest or discount rate. Web description calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). The correct npv formula in excel uses the npv function to calculate the present value of a.

Net Present Value Excel Template

Web capital budgeting fundamentals discounted payback period residual income (ri) corporate dividend policy decision dividend retention ratio implied dividend growth rate what is present value? The formula for npv is: The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Syntax npv (rate,value1,.

Net Present Value Calculator Excel Template SampleTemplatess

Step 2 calculate the net value of debt financing (pvf), which is the sum of. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. =pv (rate, nper, pmt, [fv], [type]) open present value.xlsx and go to the pv workbook, or type what's in the screen.

How to calculate Present Value using Excel

April 12, 2022 net present value is used in capital budgeting and investment planning so that the profitability of a project or investment can be analyzed. For example, project x requires an. Syntax npv (rate,value1, [value2],.) the npv function syntax has the following arguments: Web npv calculates that present value for each of the series of cash flows and adds.

Net Present Value Calculator Excel Templates

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. It is used to determine the profitability you derive from a project. April 12, 2022 net present.

10 Excel Net Present Value Template Excel Templates

Web capital budgeting fundamentals discounted payback period residual income (ri) corporate dividend policy decision dividend retention ratio implied dividend growth rate what is present value? The nper argument is 3*12 for twelve monthly payments over three years. Net present value is calculated using the formula given below. This is important because it factors in the time. April 12, 2022 net.

Net Present Value Excel Template

The big difference between pv and npv is that npv takes into account the initial investment. The nper argument is 3*12 for twelve monthly payments over three years. Irr irr is based on npv. Step 2 calculate the net value of debt financing (pvf), which is the sum of. Present value is discounted future cash flows.

Best Net Present Value Formula Excel transparant Formulas

Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Irr irr is based on npv. Future value is the amount of money you will have at a. The present value (pv) is an estimation of how much a future. While you can calculate pv in excel, you can also calculate net present value(npv).

10 Excel Net Present Value Template Excel Templates

At the same time, you'll learn how to use the pv function in a formula. Step 2 calculate the net value of debt financing (pvf), which is the sum of. Web the syntax for calculating present value ( pv) is: Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of.

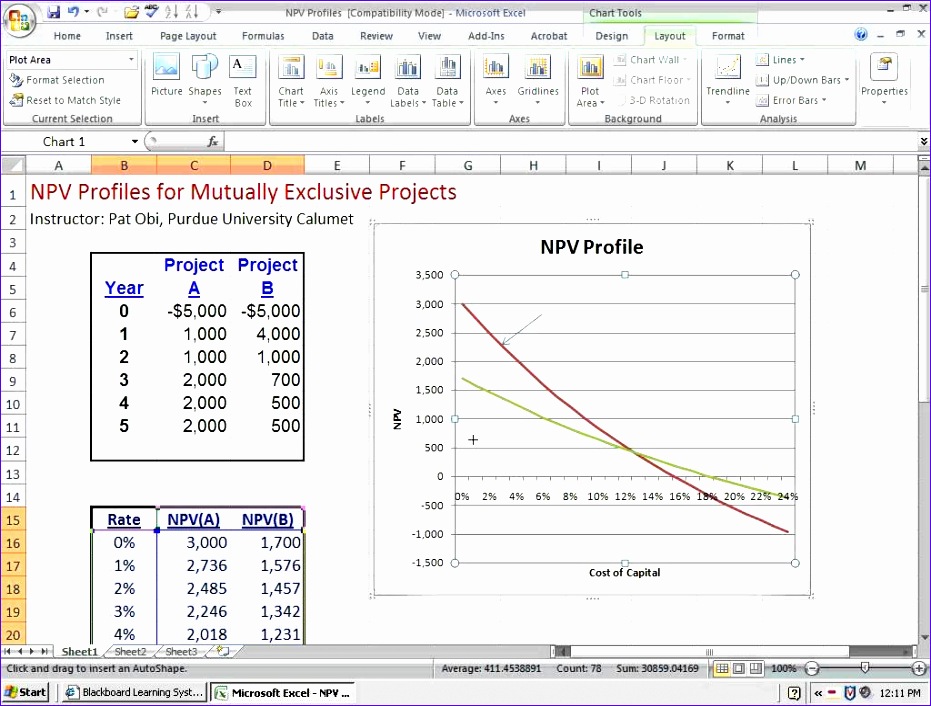

Ad enjoy low prices on earth's biggest selection of books, electronics, home, apparel & more. Web similarly, we have to calculate it for other values. While you can calculate pv in excel, you can also calculate net present value(npv). Where n is the number of cash flows, and i is the interest or discount rate. The present value (pv) is an estimation of how much a future. The big difference between pv and npv is that npv takes into account the initial investment. Web step 1 calculate the value of the unlevered firm or project (vu), i.e. Present value of a single cash flow if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified number of periods, the formula for this. This is important because it factors in the time. Irr irr is based on npv. For example, project x requires an. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Its value with all equity financing. To do this, discount the stream of fcfs by the unlevered cost of capital (ru). Npv is the value that represents the current value of all the future cash flows without the initial investment. Step 2 calculate the net value of debt financing (pvf), which is the sum of. Net present value is the difference between pv of cash flows and pv of cash outflows. Web net present value excel template updated: At the same time, you'll learn how to use the pv function in a formula.