Printable Form 1099 Misc

Printable Form 1099 Misc - Start by gathering all the necessary information, such as your taxpayer. Read customer reviews & find best sellers. Web print and file copy a downloaded from this website; Ad get the latest 1099 misc online. Ad browse & discover thousands of brands. Get tax form (1099/1042s) update direct deposit. Fill in the empty areas; You must also complete form 8919 and attach it to. Pricing starts as low as. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of.

Free Printable 1099 Misc Forms Free Printable

Involved parties names, places of residence and phone numbers. At least $10 in royalties. You must also complete form 8919 and attach it to. Quick & secure online filing. A penalty may be imposed for filing with the irs.

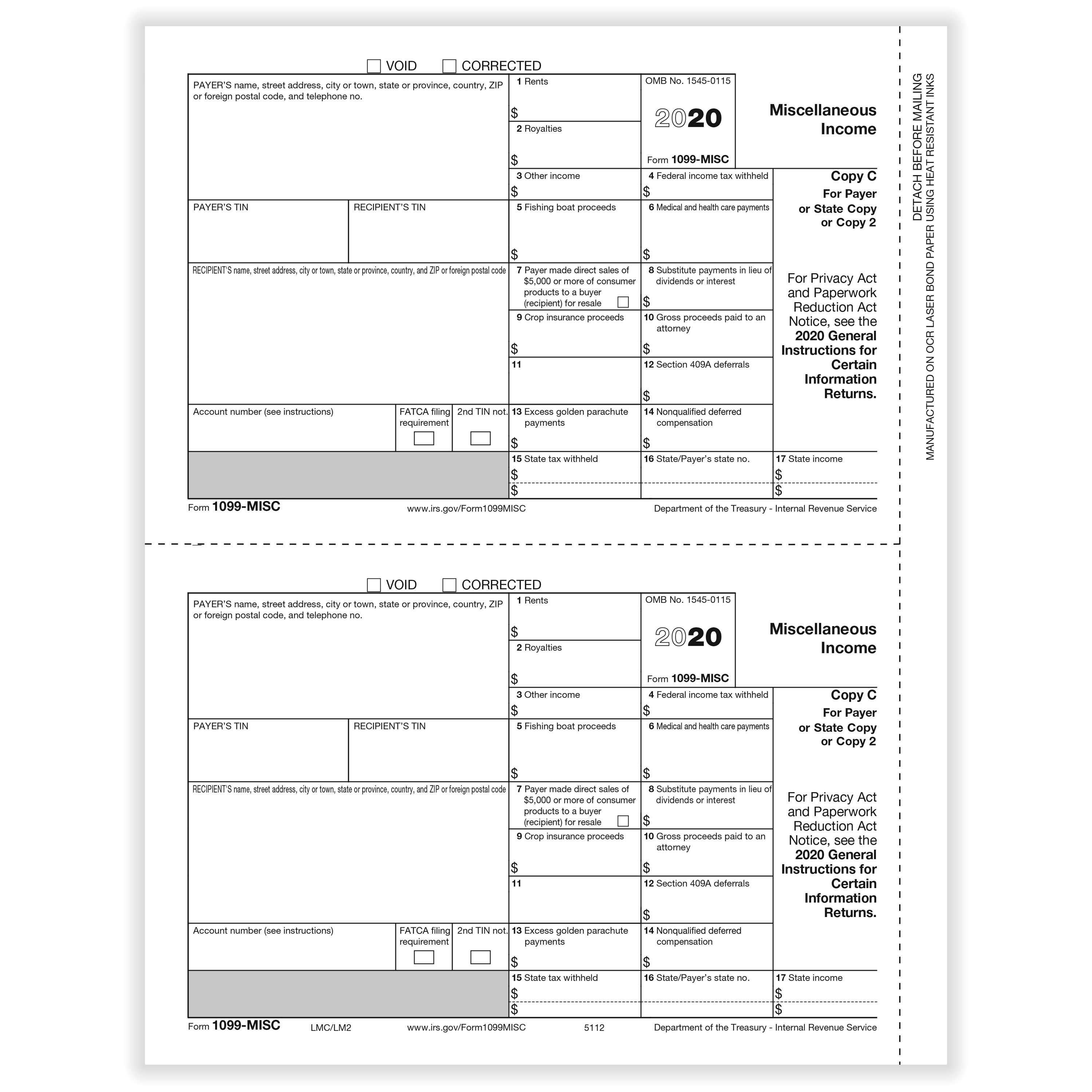

1099MISC 3Part Continuous 1" Wide Formstax

Start by gathering all the necessary information, such as your taxpayer. Read customer reviews & find best sellers. Find deals on 1099 tax forms on amazon Ad browse & discover thousands of brands. A penalty may be imposed for filing with the irs.

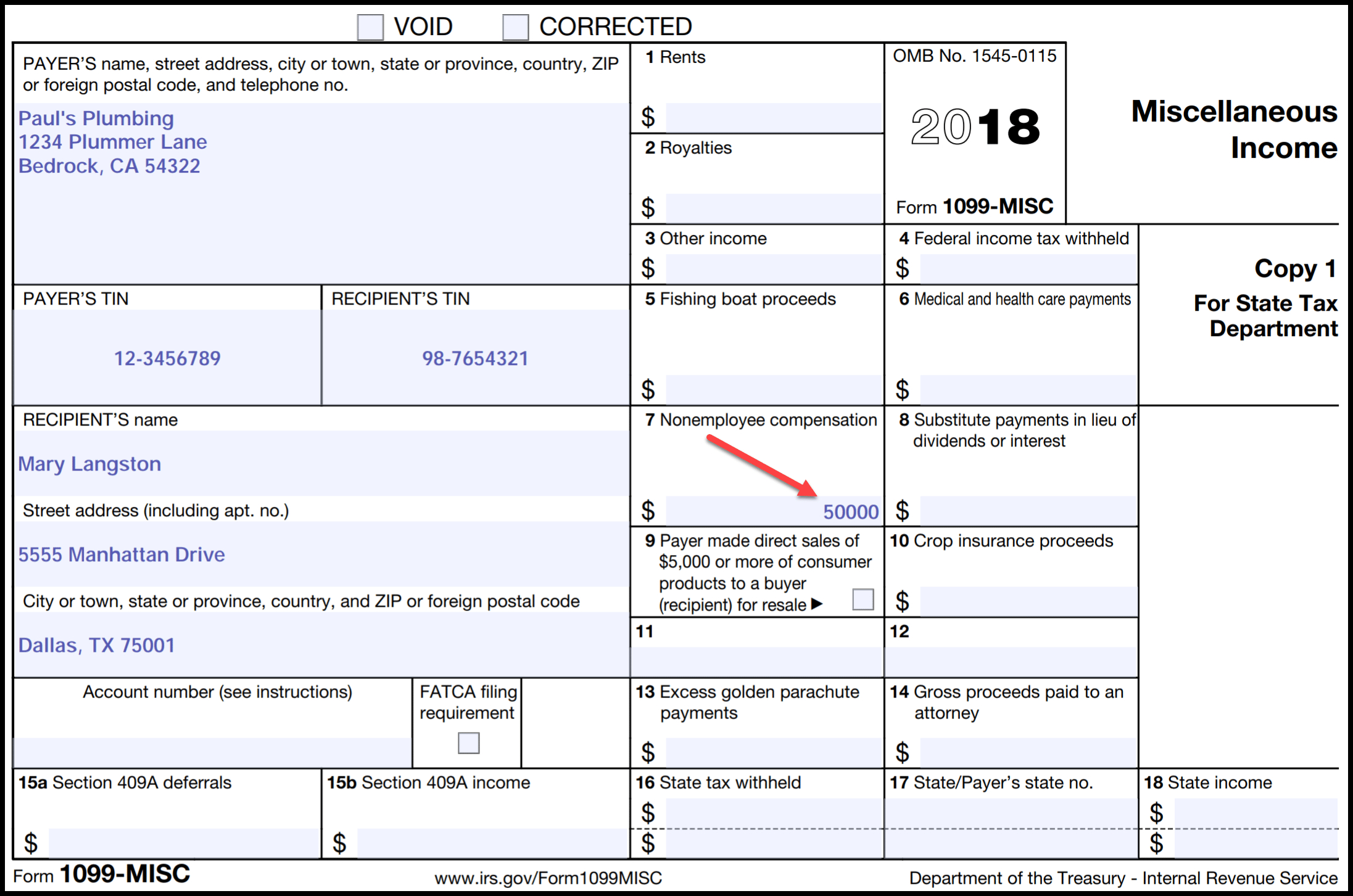

When is tax form 1099MISC due to contractors? GoDaddy Blog

A penalty may be imposed for filing with the irs. Web print and file copy a downloaded from this website; Pricing starts as low as. Involved parties names, places of residence and phone numbers. Quick & secure online filing.

1099 MISC Form 1099 Form Copy C 1099 Form Formstax

You must also complete form 8919 and attach it to. Web print and file copy a downloaded from this website; Ad get the latest 1099 misc online. Start by gathering all the necessary information, such as your taxpayer. For your protection, this form may show only the last four digits of your social security number.

1099MISC tax form DIY guide ZipBooks

Ad get the latest 1099 misc online. Pricing starts as low as. Get tax form (1099/1042s) update direct deposit. Web print and file copy a downloaded from this website; Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of.

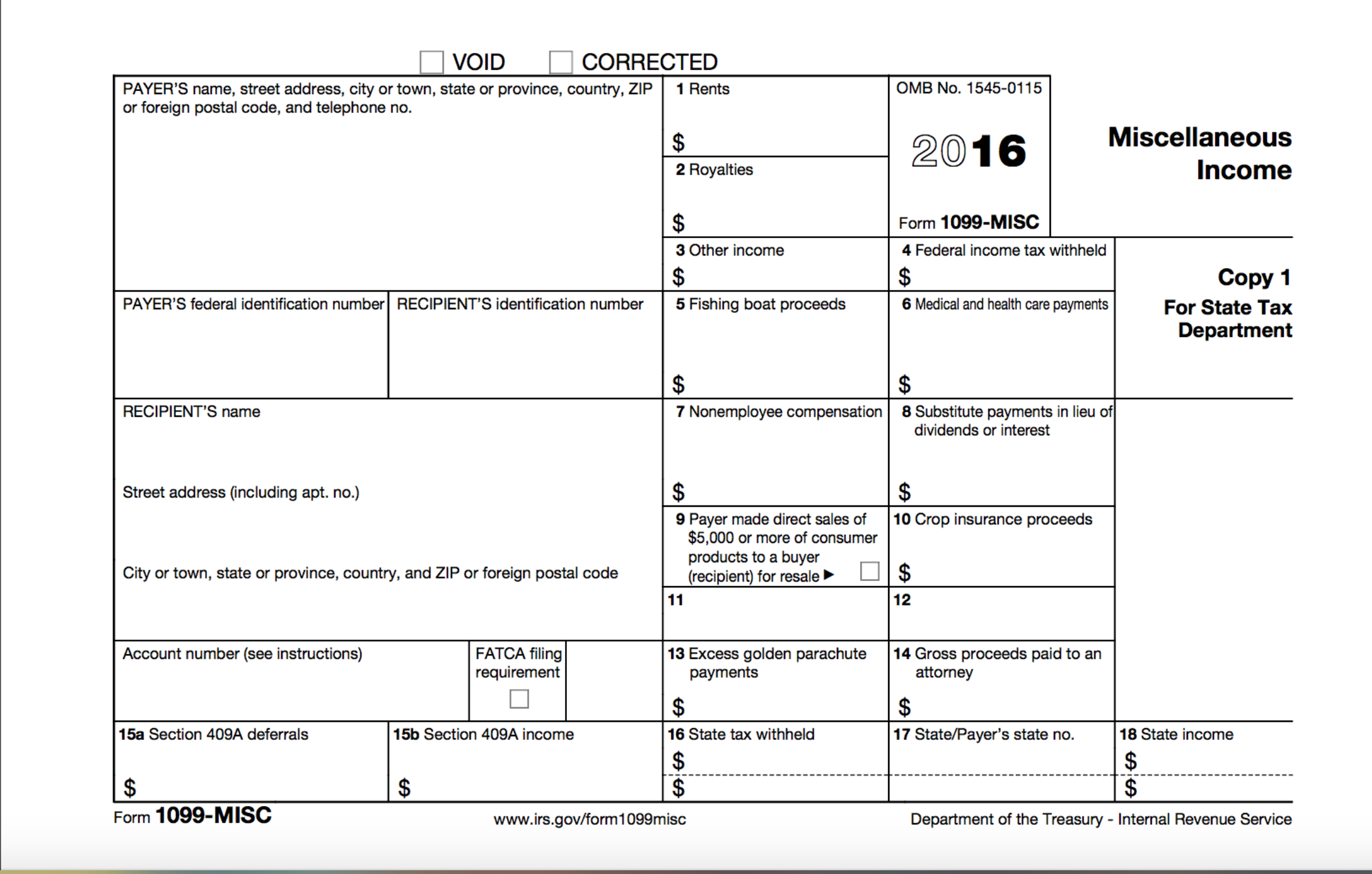

Printable 1099 Misc Tax Form Template Printable Templates

Find deals on 1099 tax forms on amazon You must also complete form 8919 and attach it to. Ad browse & discover thousands of brands. Pricing starts as low as. Read customer reviews & find best sellers.

1099MISC Form Printable and Fillable PDF Template

At least $10 in royalties. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Web print and file copy a downloaded from this website; A penalty may be imposed for filing with the irs. Web instructions for recipient recipient’s taxpayer identification number (tin).

What is a 1099Misc Form? Financial Strategy Center

Pricing starts as low as. Find deals on 1099 tax forms on amazon Quick & secure online filing. Web print and file copy a downloaded from this website; Do not miss the deadline

Form 1099MISC Miscellaneous Definition

Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Ad browse & discover thousands of brands. Fill in the empty areas; Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number.

6 mustknow basics form 1099MISC for independent contractors Bonsai

Pricing starts as low as. Web print and file copy a downloaded from this website; For your protection, this form may show only the last four digits of your social security number. Fill in the empty areas; Ad get the latest 1099 misc online.

Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Ad get the latest 1099 misc online. Fill, edit, sign, download & print. You must also complete form 8919 and attach it to. Web instructions for recipient recipient’s taxpayer identification number (tin). Involved parties names, places of residence and phone numbers. For your protection, this form may show only the last four digits of your social security number. Find deals on 1099 tax forms on amazon Start by gathering all the necessary information, such as your taxpayer. Fill in the empty areas; Get tax form (1099/1042s) update direct deposit. Read customer reviews & find best sellers. Quick & secure online filing. Do not miss the deadline Pricing starts as low as. Web print and file copy a downloaded from this website; Ad browse & discover thousands of brands. A penalty may be imposed for filing with the irs. At least $10 in royalties.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)