Tax Deductions Template

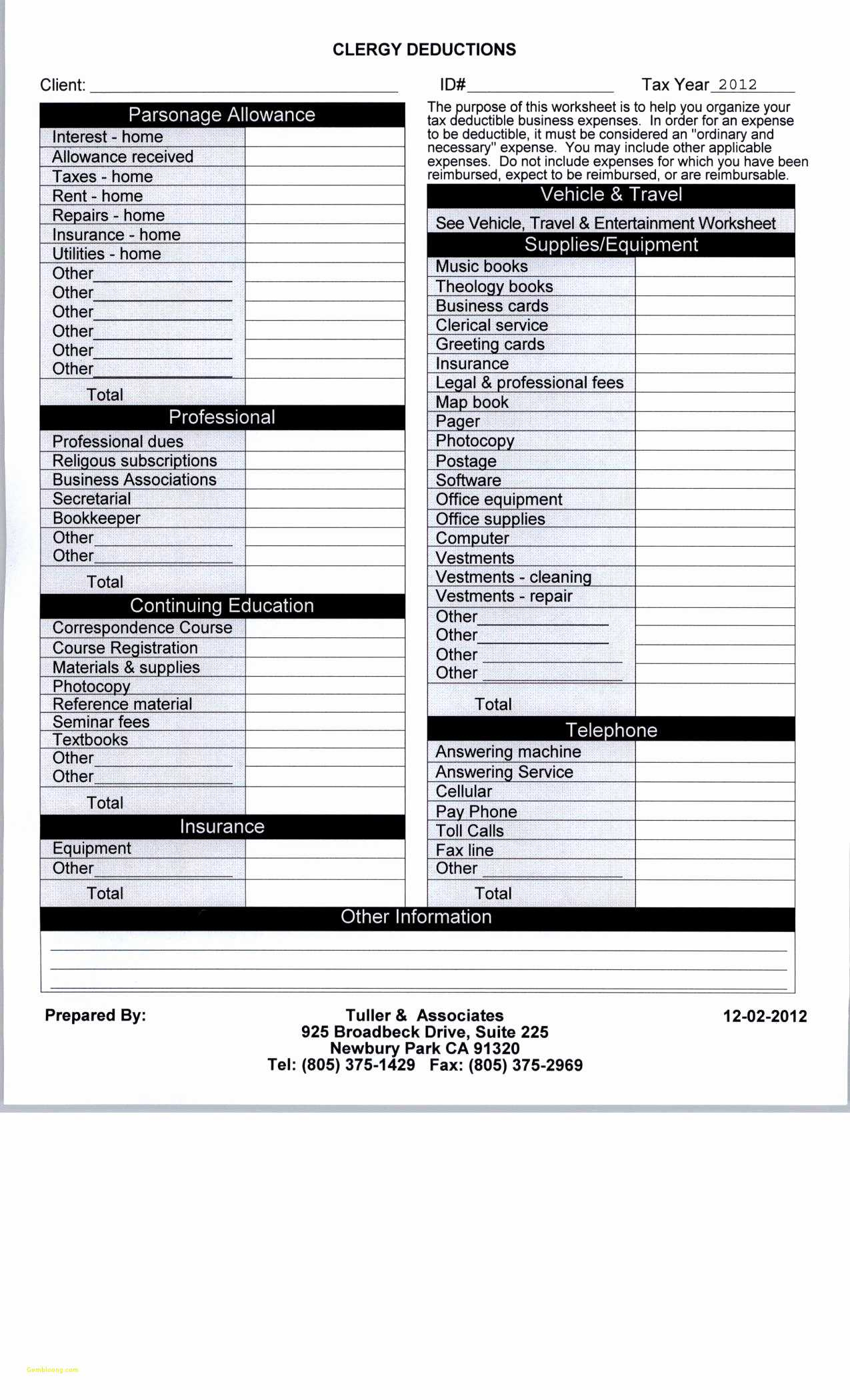

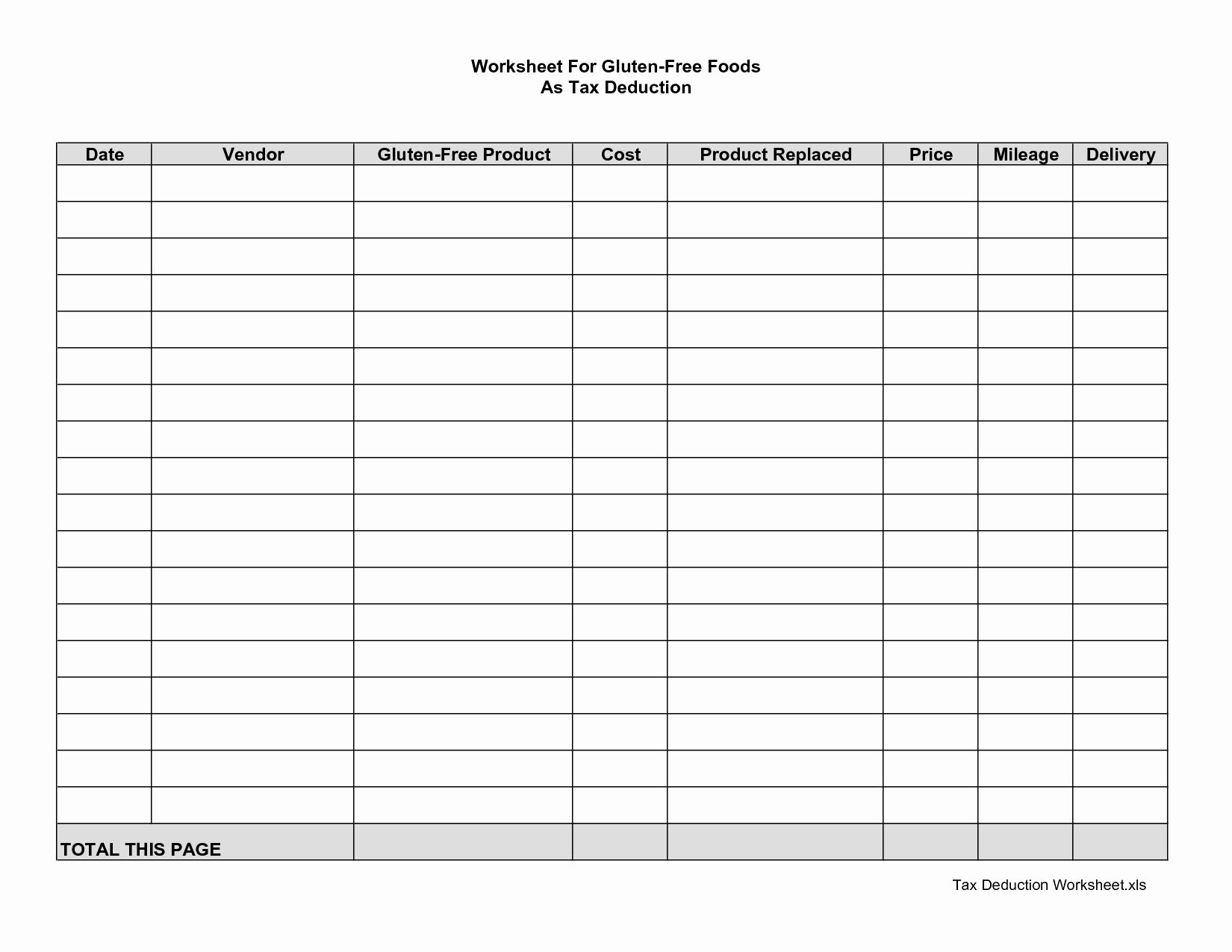

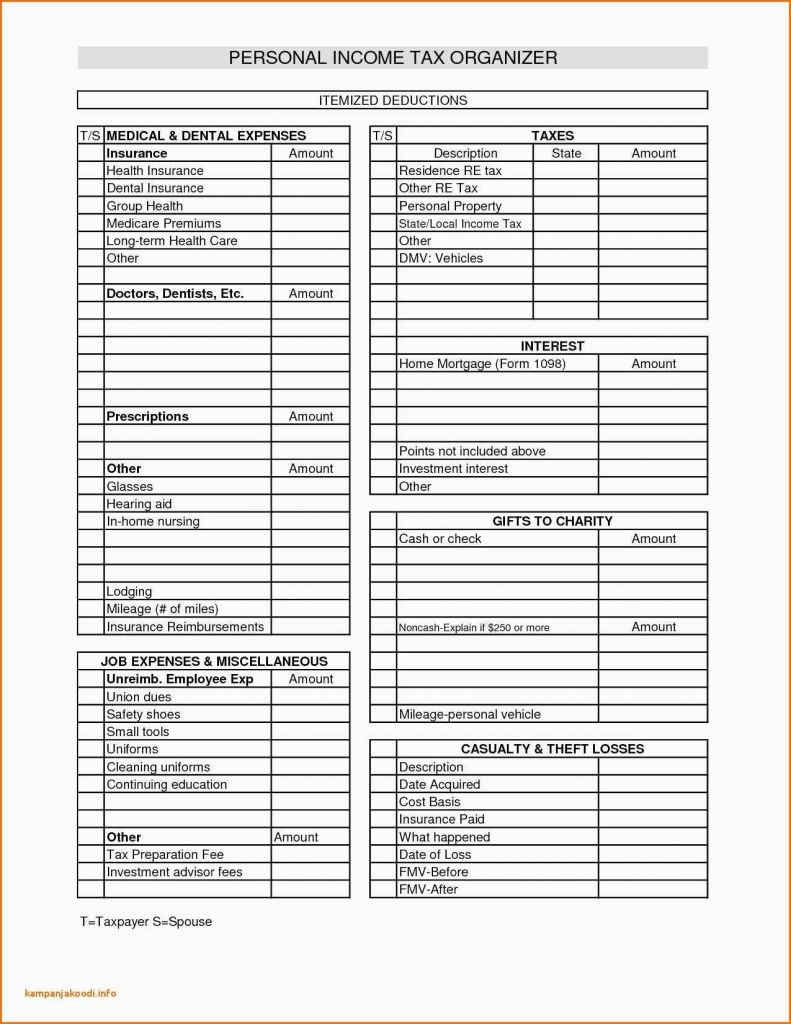

Tax Deductions Template - Ad reliably fast and accurate payroll tax service by adp®. Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Web deductible taxes are reported on form 1040, schedule a in the taxes you paid section. It is also referred to as. Browse & discover thousands of unique brands. Talk with adp® sales today. A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. In most cases, your federal income tax. Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions.

Tax Deductions Log Printable Moderntype Designs

A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax. (a) 230] are to take into account the revised tax rates. Web check out our tax deduction template selection for the very best in unique or custom, handmade pieces from our templates shops. Web this schedule is used by.

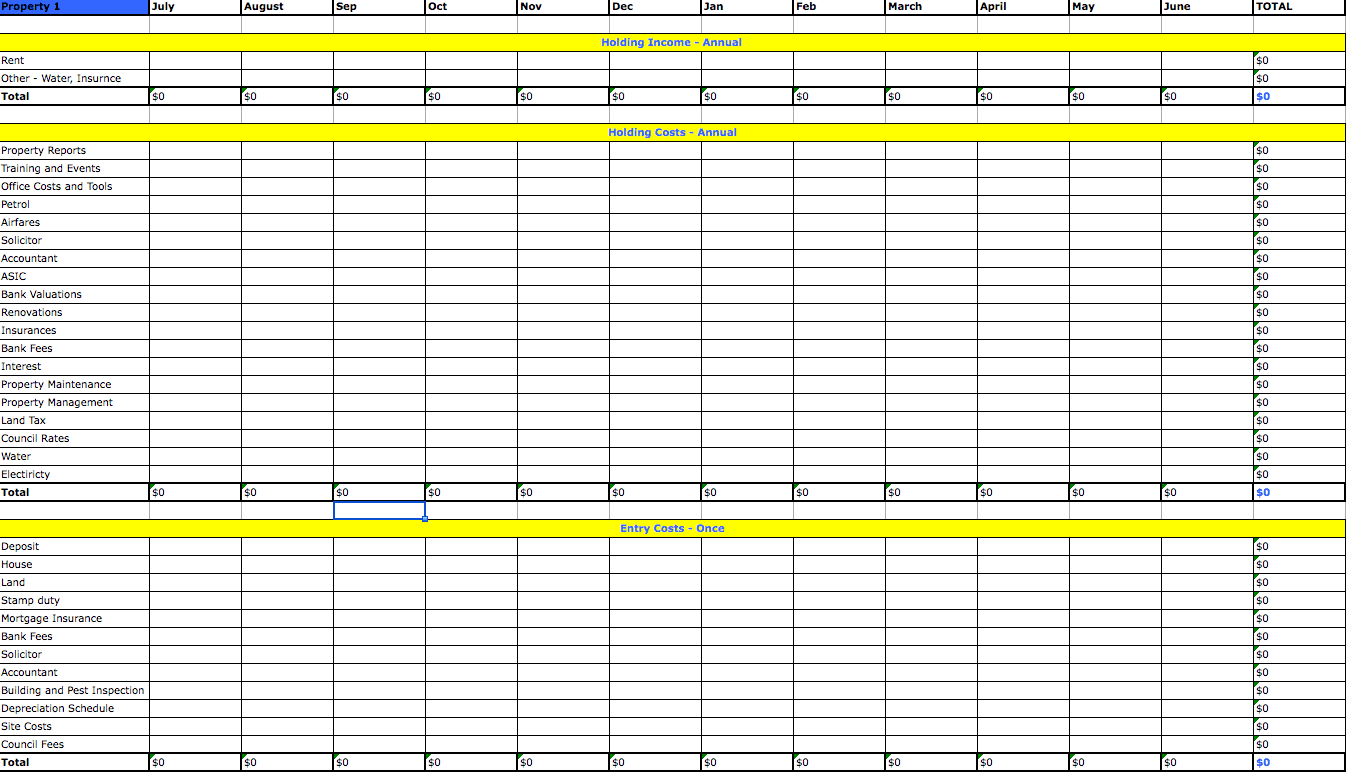

Tax Deduction Spreadsheet Excel Spreadsheet Downloa tax

Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Web go to www.irs.gov/schedulea for instructions and the latest information. Highlight all the rows and columns of your transaction detail, including headers. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. A deduction is any.

itemized deductions spreadsheet —

Web check out our tax deduction template selection for the very best in unique or custom, handmade pieces from our templates shops. It is also referred to as. This template helps you easily estimate your itemized deductions. In most cases, your federal income tax. Browse & discover thousands of unique brands.

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

Web this payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. For example, if you earn $100,000 this. Find the current list of tax deductions for.

Tax Deduction Spreadsheet Excel Glendale Community

This template helps you easily estimate your itemized deductions. Read customer reviews & best sellers. If you are claiming a. Web a tax deduction occurs when a certain expense can be used to reduce the amount of your income subject to income taxes. All you need to use it is to select the size of the page, download the pdf.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Deduction for state or local income (or sales taxes in lieu of income. Web this schedule is used by filers to report itemized deductions. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web income & deduction overview your.

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

Calculate over 1,500 tax planning strategies automatically and save tens of thousands In most cases, your federal income tax. You can edit the fine print to match your. Web this schedule is used by filers to report itemized deductions. Web prepare your federal income tax return with the help of these free to download and ready to use ready to.

Itemized Deductions Spreadsheet intended for Small Business Tax

A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax. You can edit the fine print to match your. Browse & discover thousands of unique brands. Highlight all the rows and columns of your transaction detail, including headers. (a) 230] are to take into account the revised tax rates.

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Web use template resignation confirmation letter need a quick and professional way to confirm your employees' resignations? If you are claiming a. For example, if you earn $100,000 this. It is also referred to as. This template helps you easily estimate your itemized deductions.

10 2014 Itemized Deductions Worksheet /

A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax. Highlight all the rows and columns of your transaction detail, including headers. Deduction for state or local income (or sales taxes in lieu of income. Talk with adp® sales today. (a) 230] are to take into account the revised.

Web this schedule is used by filers to report itemized deductions. Web a tax deduction occurs when a certain expense can be used to reduce the amount of your income subject to income taxes. Read customer reviews & best sellers. This template helps you easily estimate your itemized deductions. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web subtotals for simplicity. Calculate over 1,500 tax planning strategies automatically and save tens of thousands In most cases, your federal income tax. Talk with adp® sales today. Web do calculations of your tax deductions with this handy tracker. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. If you are claiming a. Ad reliably fast and accurate payroll tax service by adp®. Deduction for state or local income (or sales taxes in lieu of income. Web we have created an itemized deductions calculator with predefined formulas. Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. Web a tax deduction reduces the amount of income that is subject to taxation by federal and state governments. (a) 230] are to take into account the revised tax rates. It is also referred to as. Web deductible taxes are reported on form 1040, schedule a in the taxes you paid section.