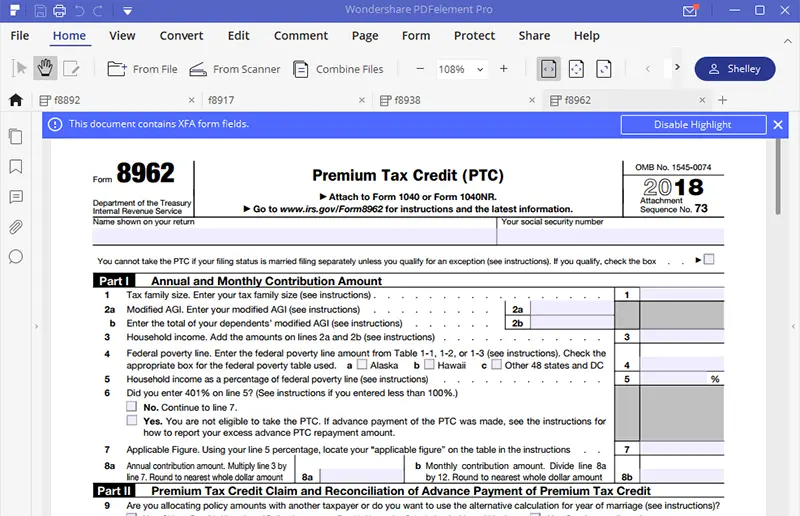

Tax Form 8962 Printable

Tax Form 8962 Printable - Save or instantly send your ready documents. Web form 8962 at the end of these instructions. Go to www.irs.gov/form8962 for instructions and. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? Ad get ready for tax season deadlines by completing any required tax forms today. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Try it for free now! You may take ptc (and aptc may. You may take ptc (and aptc may. Ad get ready for tax season deadlines by completing any required tax forms today.

form 8962 2020 2021 pdf Fill Online, Printable, Fillable Blank

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. You may take ptc (and aptc may. Ad get ready for tax season deadlines by completing any required tax forms today. Irs 8962 is the form that was.

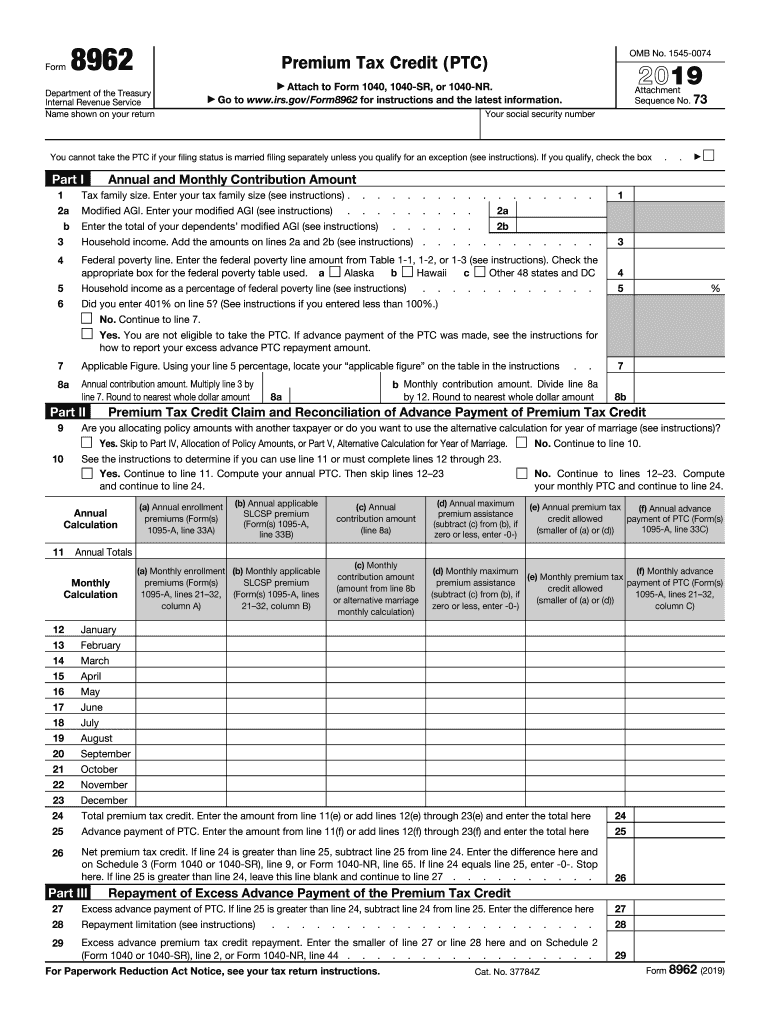

Irs Form 8962 Fillable Irs Form 8962 Instruction For How To Fill It

Be aware that 2021 electronically filed tax returns that require taxpayers to reconcile advance premium tax credit. If you’re claiming a net premium tax credit for. Irs 8962 is the form that was made for taxpayers who want to find out. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance.

Form 8962 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. You may take ptc (and aptc may. Easily fill out pdf blank, edit,.

How To Fill Out Tax Form 8962

You may take ptc (and aptc may. Go to www.irs.gov/form8962 for instructions and. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). More about the federal form 8962 we last updated. Web include premium tax credit form 8962.

What Individuals Need to Know About the Affordable Care Act for 2016

Try it for free now! More about the federal form 8962 we last updated. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). If you’re claiming a net premium tax credit for. Web get 8962 form 2020 form 8962 instructions, premium tax credit score.

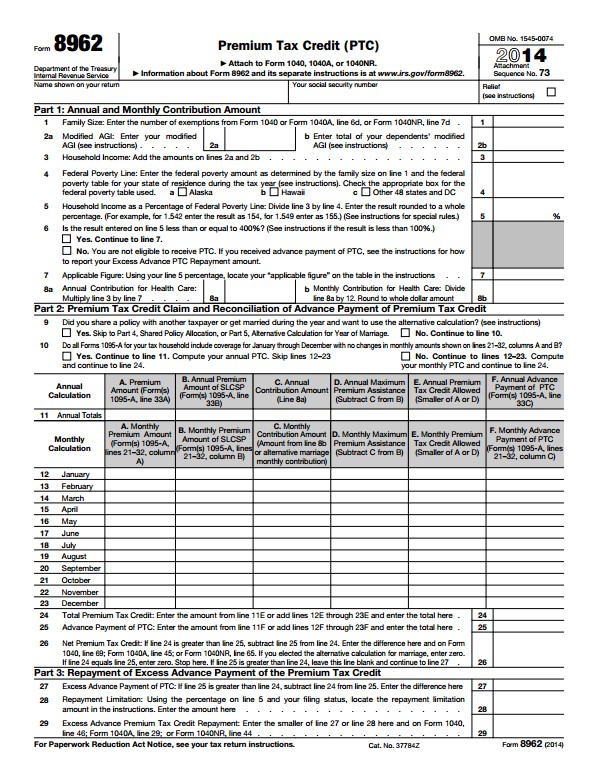

8962 (2014) Edit Forms Online PDFFormPro

Web get 8962 form 2020 form 8962 instructions, premium tax credit score form 8962 irs form 8962 8962 form tax form 8962 print form 8962 8962 form print 8962 form. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Complete, edit or print.

IRS Form 8962 Understanding Your Form 8962

Try it for free now! Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? Easily fill out pdf blank, edit, and sign them. Irs 8962 is the form that was made for taxpayers who want to find out. Upload, modify or create forms.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Easily fill out pdf blank, edit, and sign them. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? Sign it in a few clicks draw your signature, type it,. More about the federal form 8962 we last updated. Try it for free now!

Where Can I Pick Up Irs Forms And Instructions Darrin Kenney's Templates

Complete, edit or print tax forms instantly. You may take ptc (and aptc may. Go to www.irs.gov/form8962 for instructions and. More about the federal form 8962 we last updated. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc).

NEW EXAMPLE HOW TO FILL OUT FORM 8962 Form

Try it for free now! Web include premium tax credit form 8962. Ad get ready for tax season deadlines by completing any required tax forms today. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. Web when you're done in turbotax, you'll need to.

Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Ad get ready for tax season deadlines by completing any required tax forms today. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Try it for free now! Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health. Web form 8962 at the end of these instructions. Be aware that 2021 electronically filed tax returns that require taxpayers to reconcile advance premium tax credit. Sign it in a few clicks draw your signature, type it,. Edit your irs form 8962 online type text, add images, blackout confidential details, add comments, highlights and more. Web include premium tax credit form 8962. You may take ptc (and aptc may. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web get 8962 form 2020 form 8962 instructions, premium tax credit score form 8962 irs form 8962 8962 form tax form 8962 print form 8962 8962 form print 8962 form. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Upload, modify or create forms. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? Go to www.irs.gov/form8962 for instructions and. Save or instantly send your ready documents. Ad get ready for tax season deadlines by completing any required tax forms today.

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)