Tax Provision Template

Tax Provision Template - Web review the relevant requirements for presentation and disclosure of income taxes. This is especially important when the. Web the existing tax provision template may not include the mechanism to properly net the deferred items across jurisdictions. Thus the provision of the income tax for the. Web provision for income taxes. = $ 70,000 * 30%. You can export it in multiple formats like jpeg, png and svg and easily add it to word. How to calculate the provision for income taxes on an. Web the template also provides formatting and structure for students to input their tax provision journal entries, the completed income statement, and the rate. Web now, the calculation of the provision of the income tax will be as follows:

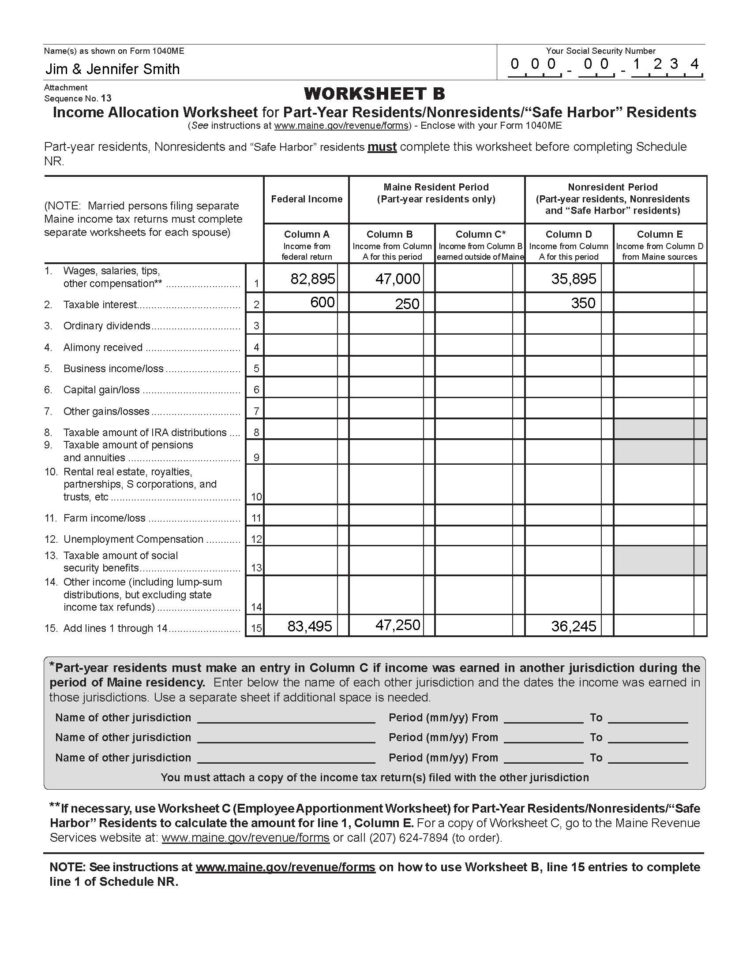

Tax Worksheet

Provision for income tax = $ 21,000. Thus the provision of the income tax for the. This section provides checklists for the steps involved in the external financial reporting of. If a company operates in multiple. = $ 70,000 * 30%.

tax provision DriverLayer Search Engine

Web flowchart for tax provision preparation. [learn how we can help streamline. Thus the provision of the income tax for the. Web the template also provides formatting and structure for students to input their tax provision journal entries, the completed income statement, and the rate. Web now, the calculation of the provision of the income tax will be as follows:

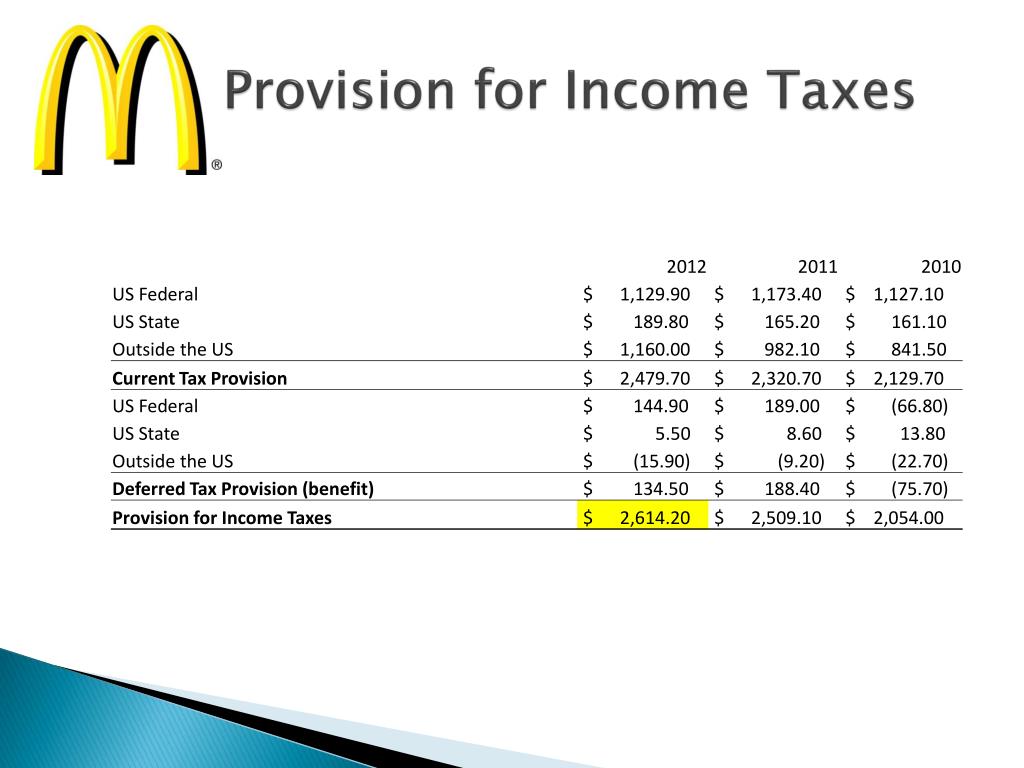

PPT Detailed Analysis of the Financial Reports McDonald’s PowerPoint

Web review the relevant requirements for presentation and disclosure of income taxes. Web now, the calculation of the provision of the income tax will be as follows: Businesses can receive up to $26k per eligible employee. While a provision is a financial. You can export it in multiple formats like jpeg, png and svg and easily add it to word.

Rockwood Holdings, Inc. FORM 8K EX99.2 October 19, 2011

In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. If a company operates in multiple. Businesses can receive up to $26k per eligible employee. = $ 70,000 * 30%. [learn how we can help streamline.

Tax Provision Calculation Template Card Template

Web the existing tax provision template may not include the mechanism to properly net the deferred items across jurisdictions. Web a tax provision is the estimated amount that your business is expected to pay in state and federal taxes for the current year. Web thomson reuters onesourcetm tax provision is a simple and intuitive application that speeds up the financial.

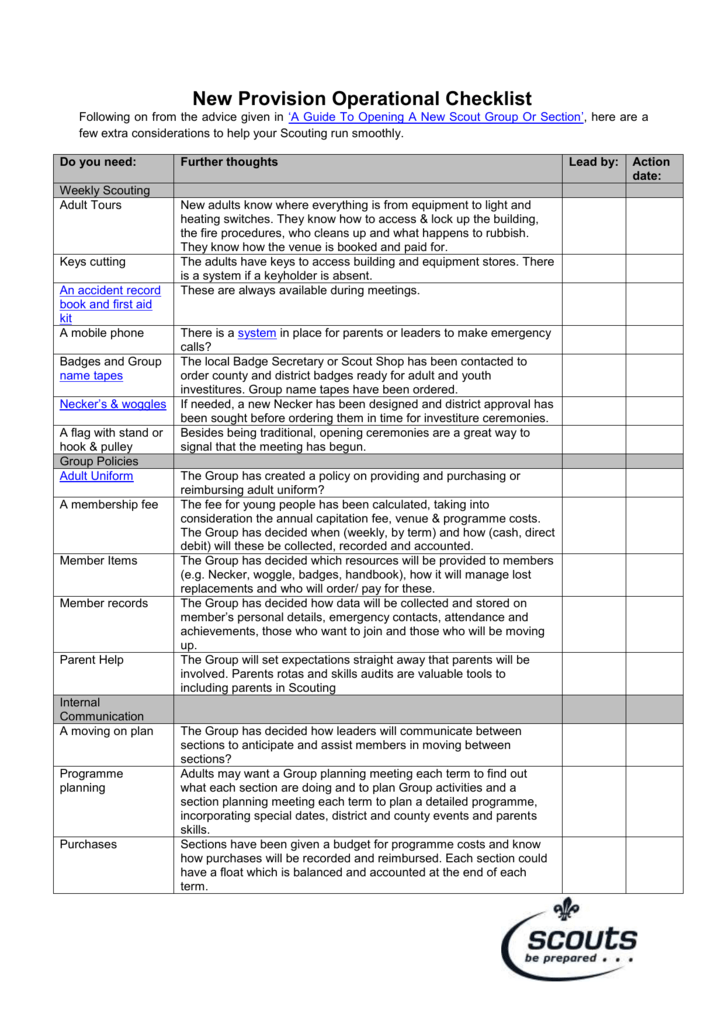

new provision checklist

While a provision is a financial. Web review the relevant requirements for presentation and disclosure of income taxes. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. 4.1 if all, or any portion, of the payments and benefits (as determined by the.

Tax Worksheet For Students Gambaran

Sign up & make payroll a breeze. Web here's the skinny on how companies estimate and account for income taxes on their income statements. Businesses can receive up to $26k per eligible employee. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. How to calculate the provision for income taxes.

tax provision DriverLayer Search Engine

Web onesource workpapers is advanced workpaper technology for the direct tax suite. If a company operates in multiple. Provision for income tax = $ 21,000. Web provision for income taxes. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating.

How to Calculate NOPLAT for Operating ROIC (with Important Distinctions)

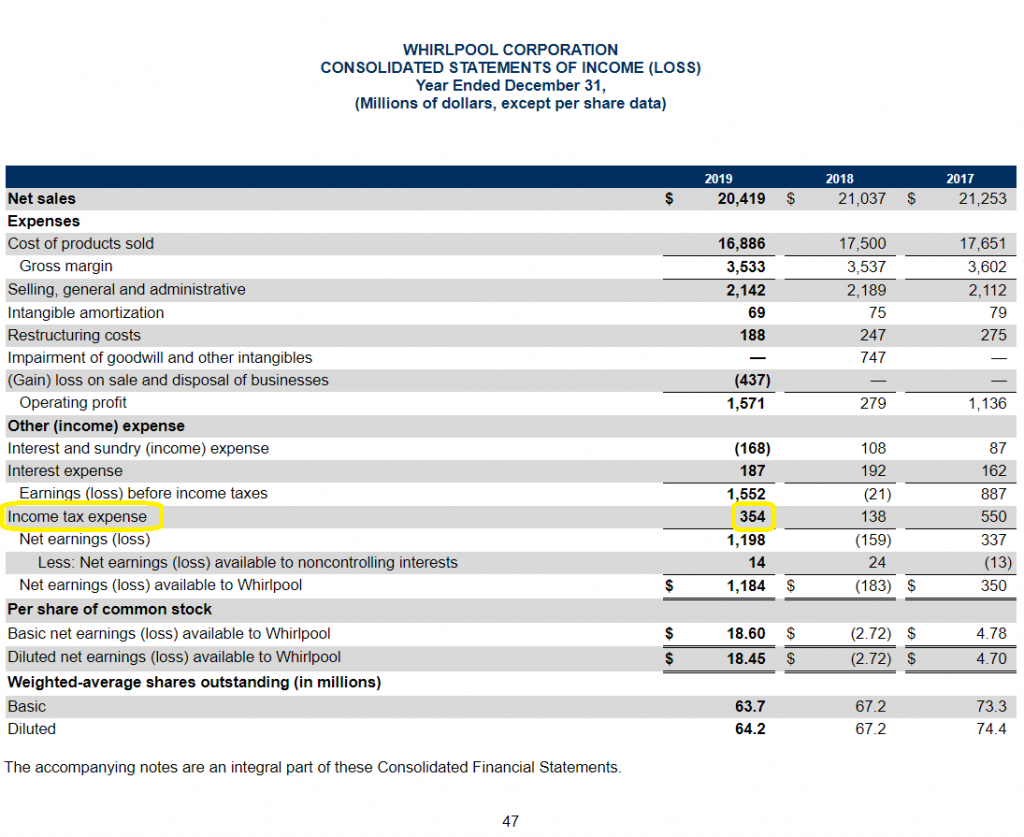

Web provision for income taxes. If a company operates in multiple. While entities may use them to help assess whether they are compliant with u.s. Web onesource workpapers is advanced workpaper technology for the direct tax suite. = $ 70,000 * 30%.

tax provision DriverLayer Search Engine

How to calculate the provision for income taxes on an. In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. This section provides checklists for the steps involved in the external financial reporting of. Web flowchart for tax provision preparation. Ad get a payroll tax refund & receive up to $26k.

Web review the relevant requirements for presentation and disclosure of income taxes. Web the sample disclosures are intended to provide general information only. In a financial statement or personal budget, an estimate for one's total income tax liability for a given year. You can easily edit this template using creately. Provision for income tax = $ 21,000. Web tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. Sign up & make payroll a breeze. 4.1 if all, or any portion, of the payments and benefits (as determined by the company) provided under this agreement, if any, either alone or together with other. If a company operates in multiple. While a provision is a financial. Web provision for income taxes. We simplify complex tasks to give you time back and help you feel like an expert. Ad simply the best payroll service for small business. Web onesource workpapers is advanced workpaper technology for the direct tax suite. = $ 70,000 * 30%. [learn how we can help streamline. Web here's the skinny on how companies estimate and account for income taxes on their income statements. If a company operates in multiple. Businesses can receive up to $26k per eligible employee. Web the template also provides formatting and structure for students to input their tax provision journal entries, the completed income statement, and the rate.