Asc 842 Lease Amortization Schedule Template

Asc 842 Lease Amortization Schedule Template - Web practice by entities within its scope when applying lease accounting requirements to common control arrangements. Web download the free guide now excel templates for operating and financing leases under asc 842. What is a capital/finance lease? Capital lease criteria under asc 840 3. Web this guide discusses lessee and lessor accounting under asc 842. Web what is deferred rent? Accounting for leasehold improvements topic. Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. Web under asc 842, regardless of the classification of the lease, operating, or finance, a company must recognize a right of use asset for the majority of leases.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Deferred rent under asc 840 example #2: Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. Web what is deferred rent? Deferred rent examples under asc 840.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Deferred rent under asc 840 example #2: Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc.

Rent Abatement & RentFree Period Accounting for US GAAP

Capital lease criteria under asc 840 3. Web what is deferred rent? Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Deferred rent under asc 840 example #2: Web practice by entities within its scope when applying lease accounting requirements to common control arrangements.

Sensational Asc 842 Excel Template Dashboard Download Free

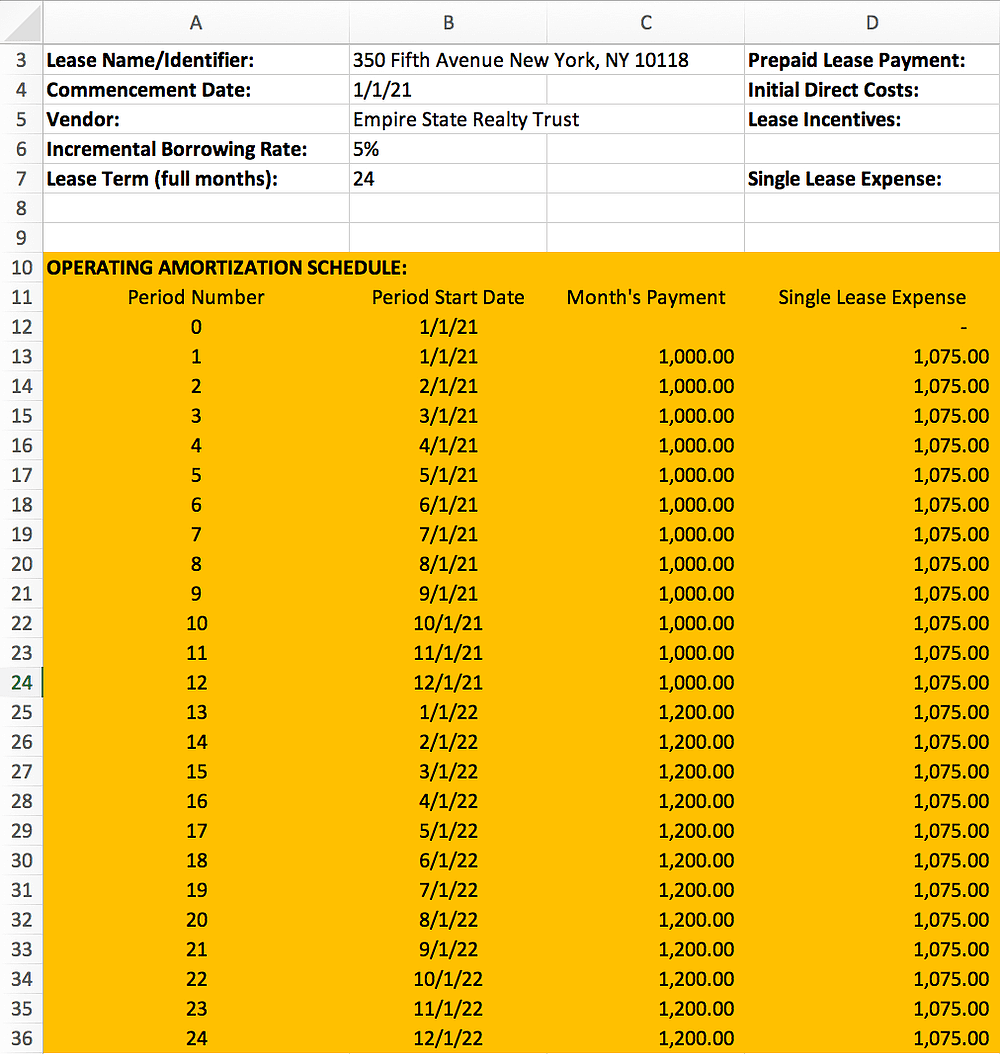

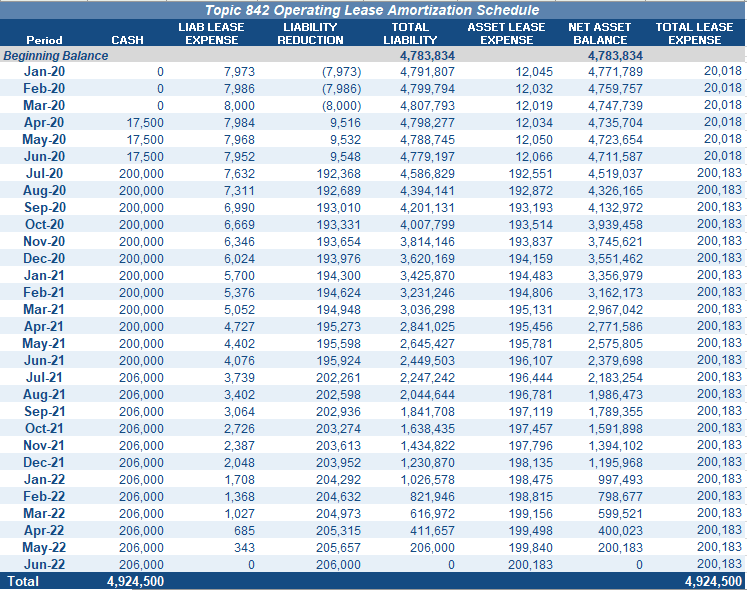

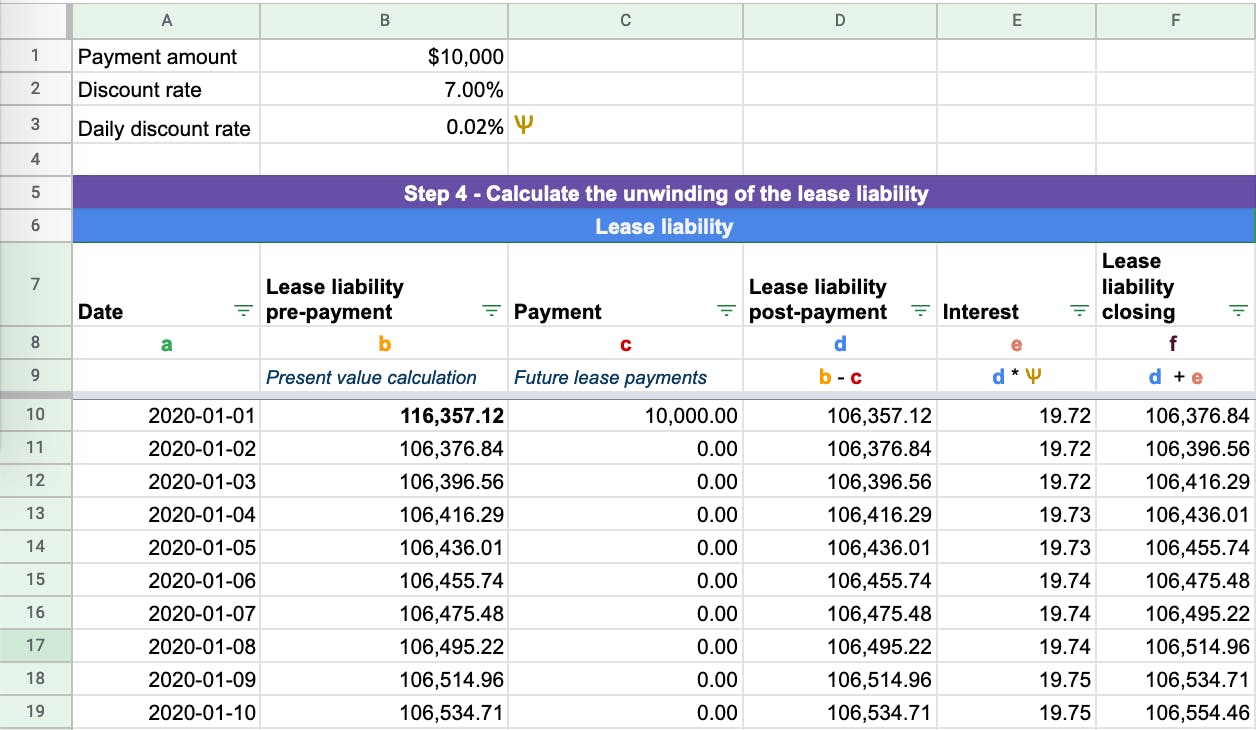

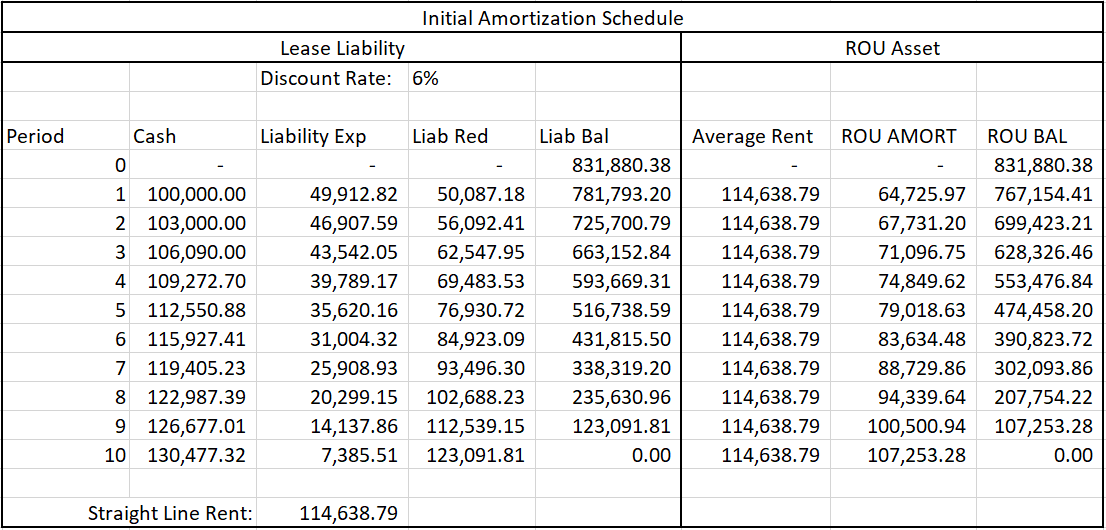

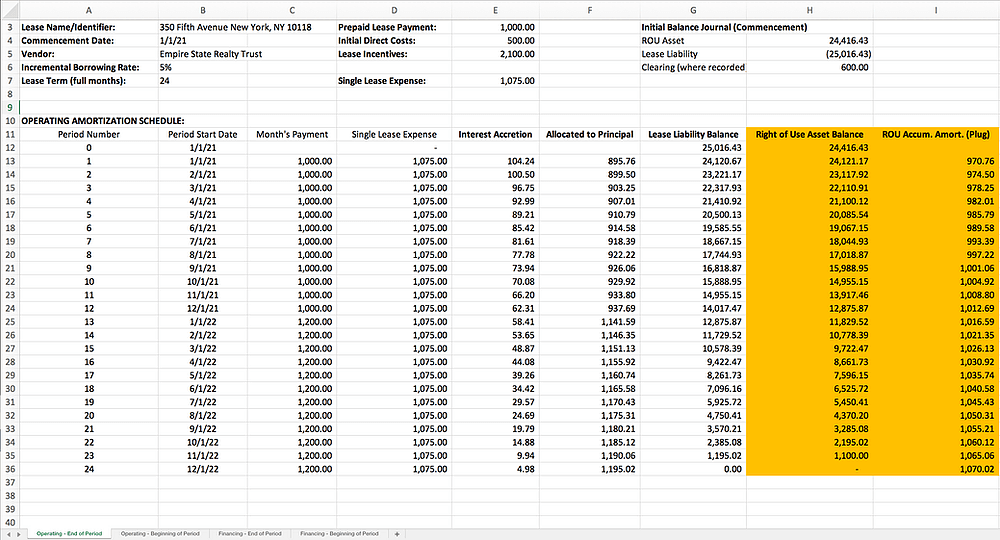

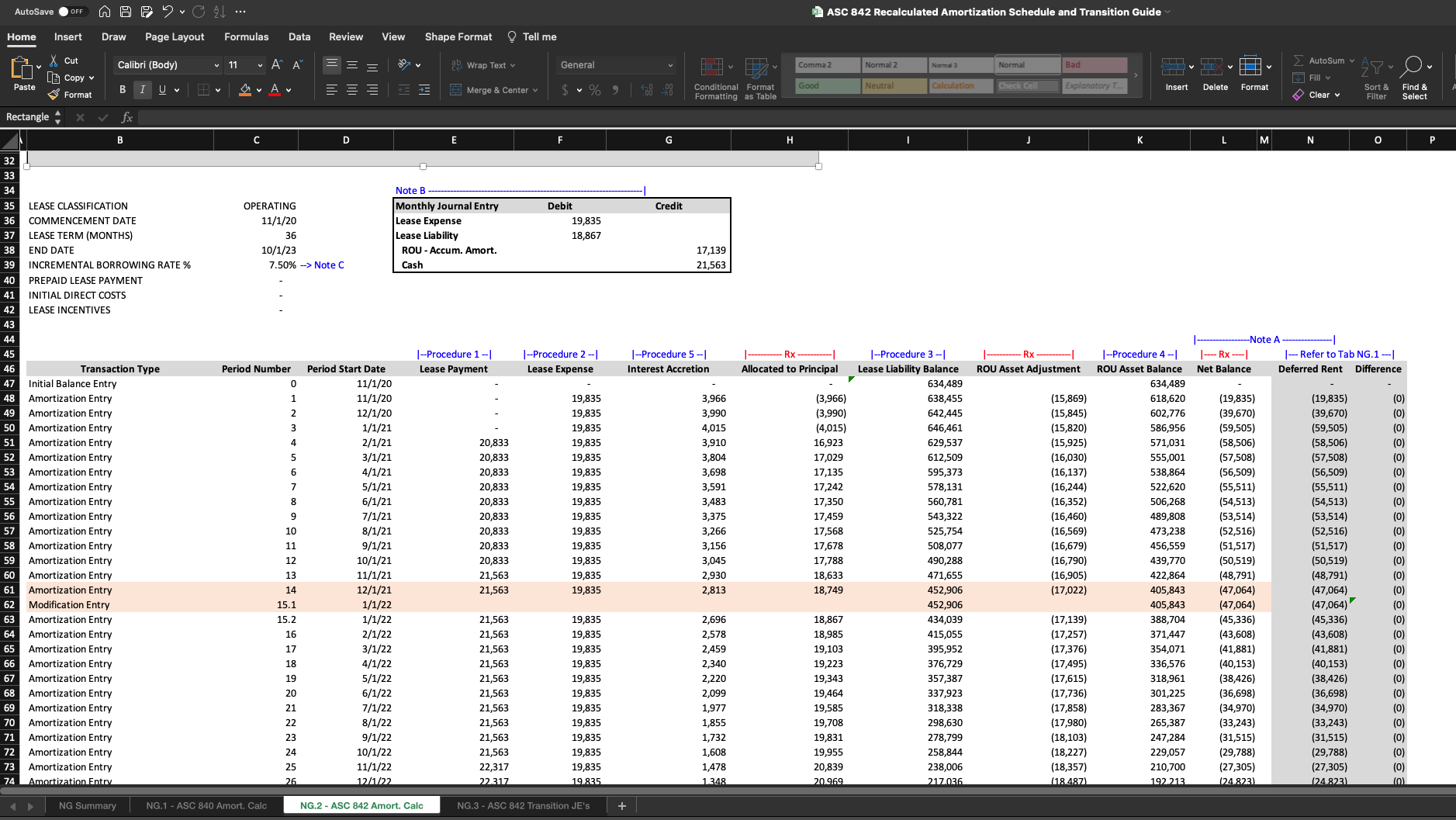

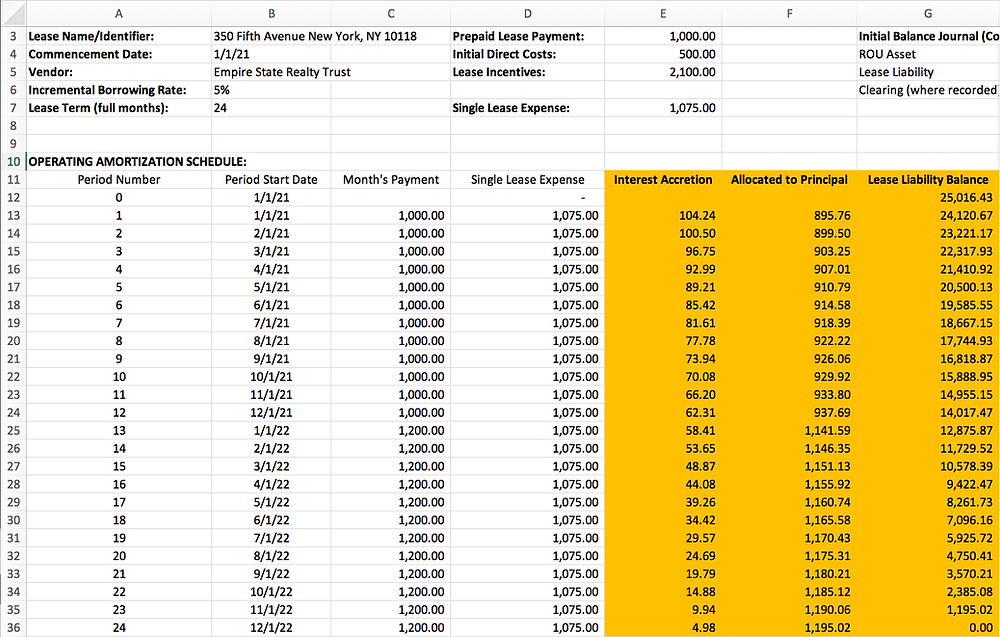

Web under fasb asc 842 the amortization period for leasehold improvements cannot be longer than the lease term for the leased asset (fasb asc 842 leasehold. Deferred rent examples under asc 840 and asc 842 example #1: Web this guide discusses lessee and lessor accounting under asc 842. Web the amortization schedule for this lease is below. Web under asc.

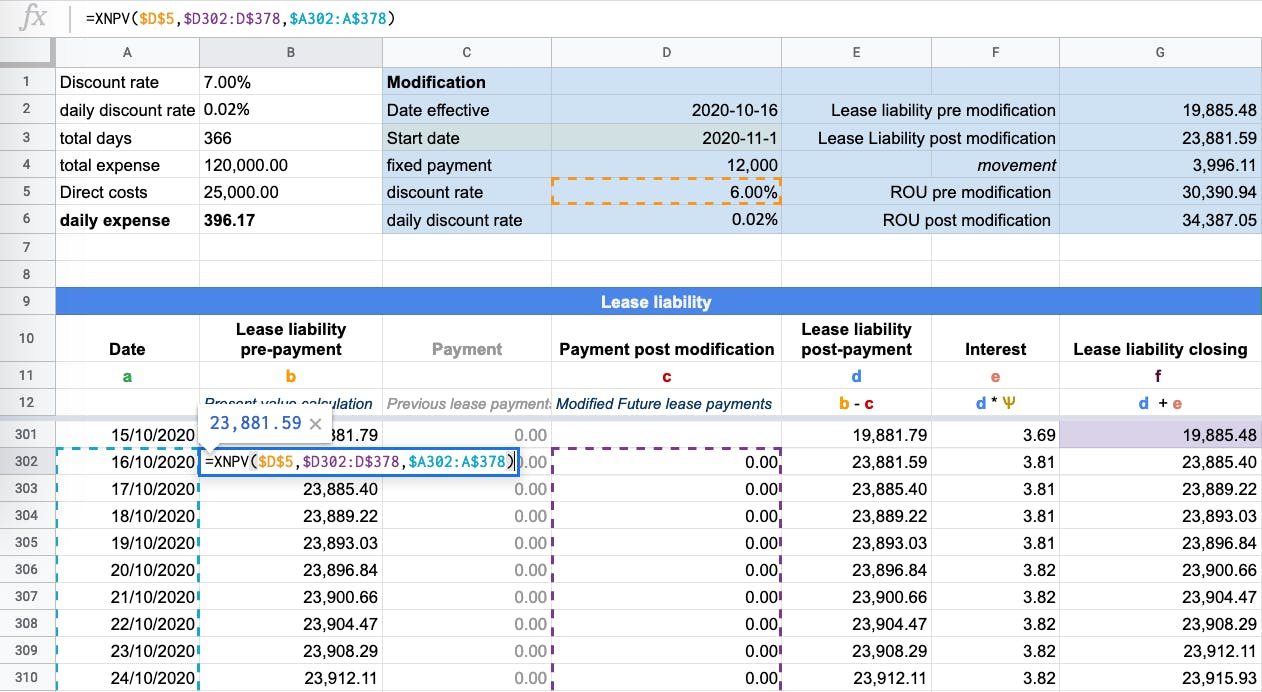

Lease Modification Accounting for ASC 842 Operating to Operating

Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Web the asc 842 lease classification template for lessees is now available for download. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Deferred rent examples under asc 840 and asc 842 example #1: The first four chapters provide an introduction and guidance on determining whether an arrangement is.

ASC 842 Excel Template Download

Web what is deferred rent? Deferred rent examples under asc 840 and asc 842 example #1: Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc.

Free Lease Amortization Schedule Excel Template

Under asc 842, operating leases and financial leases have different amortization calculations. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Web under asc 842, regardless of the.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. Web this guide discusses lessee and lessor accounting under asc 842. Web practice by entities within its scope when applying lease accounting requirements to common control arrangements. Web how to calculate your lease amortization. Under asc 842, operating leases and financial leases have different amortization calculations.

Puñado Ver a través de Decir calculo leasing excel Soldado Disponible genio

The first four chapters provide an introduction and guidance on determining whether an arrangement is (or. Web the asc 842 lease classification template for lessees is now available for download. Web what is deferred rent? Capital lease criteria under asc 840 3. Web this guide discusses lessee and lessor accounting under asc 842.

Capital lease criteria under asc 840 3. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Phone getapp capterra g2 reviews suiteapp trusted by thousands of public. Web specifically, leases that commence or are modified after the adoption date must be assessed under asc 840 for interim periods and asc 842 when preparing. Asc 842 permits lessors to gross up the income statement by presenting (1) sales or other similar taxes in revenue when such taxes are reimbursed by a lessee to the. Web the asc 842 lease classification template for lessees is now available for download. Web how to calculate your lease amortization. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web this guide discusses lessee and lessor accounting under asc 842. Web under asc 842, regardless of the classification of the lease, operating, or finance, a company must recognize a right of use asset for the majority of leases. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee info. Deferred rent examples under asc 840 and asc 842 example #1: Accounting for leasehold improvements topic. Web what is deferred rent? Under asc 842, operating leases and financial leases have different amortization calculations. Web the amortization schedule for this lease is below. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the. Web the amortization for a finance lease under asc 842 is very straightforward. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or.